President Obama has enjoyed making a point the rich, the very rich, are making more out very well under the current tax code while the rest of us suffer. His favorite example is his friend Warren Buffet. In fact, Obama even mentioned it during his State of the Union Address:

When it comes to the deficit, we’ve already agreed to more than $2 trillion in cuts and savings. But we need to do more, and that means making choices. Right now, we’re poised to spend nearly $1 trillion more on what was supposed to be a temporary tax break for the wealthiest 2 percent of Americans. Right now, because of loopholes and shelters in the tax code, a quarter of all millionaires pay lower tax rates than millions of middle-class households. Right now, Warren Buffett pays a lower tax rate than his secretary.

I’ve been working this for a long time. I’ve tried making the point that Buffet pays that SAME income tax rate as his secretary; tax on salary is straight forward and everyone uses the same schedule. I’ve also tried to point out that Buffet pays much MUCH more in taxes than his secretary; he makes very much more.

All of this is ignored as only so much right-wing buffoonery.

So, let’s look, what does Warren Buffet’s secretary – Debbie Bosanek – pay? Well, it’s reported that she pays a rate of 35.8%. And Buffet? What does he pay? The same report says he pays 17.4%.

Buffett’s secretary since 1993, Debbie Bosanek, sat next to her boss just hours after being invited by the president to the State of the Union address, where the president made her the face of tax inequality in America.

Bosanek pays a tax rate of 35.8 percent of income, while Buffett pays a rate at 17.4 percent.

“I just feel like an average citizen. I represent the average citizen who needs a voice,” said Bosanek. “Everybody in our office is paying a higher tax rate than Warren.”

Interesting. Interesting indeed. The first thing I considered when reading this is why Buffet doesn’t compensate his staff in the same way he compensates himself; namely through assets that yield capital gains. The second question I asked was, “Wait a moment, what IS the marginal rates exactly?”

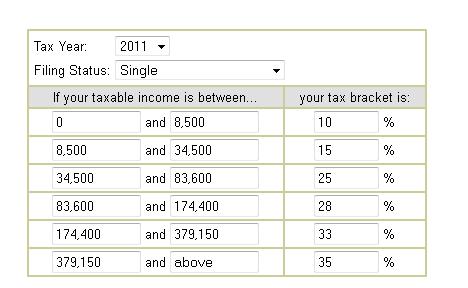

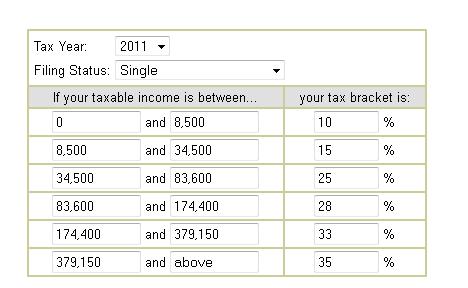

Let’s again, go look:

According to the above table, Ms. Bosanek can’t earn enough income to set her tax rate at 35.8%. In fact, the highest that any American can pay is 35%. And even if Ms. Bosanek made $1,000,000 her rate would be 32.73%. No where near the 35.8% the liberals report she pays.

According to the above table, Ms. Bosanek can’t earn enough income to set her tax rate at 35.8%. In fact, the highest that any American can pay is 35%. And even if Ms. Bosanek made $1,000,000 her rate would be 32.73%. No where near the 35.8% the liberals report she pays.

This should not be surprising; liberals suffer from a degree of lack of understanding when comes to things economic:

It’s not even close. The conservatives did better, MUCH better, than the Leftists. And it tracks exactly with political affiliation.

So the next time that you are confronted with the argument that Mr. Buffet’s secretary pays more in taxes than her boss, challenge them. Ask them questions. Ask them if they mean total dollars or tax rate. Then ask them to explain their answer.

They can’t.