I was playing around this weekend reading up on retirement accounts and options available to me when I came across this gem:

How many times have you read financial-advice stories lecturing you to max-out on your IRA, save as much as you can in your 401(k), and even pay taxes now to change your regular IRA into a Roth IRA that will be tax-free until you die?

Well, be careful how much you save.

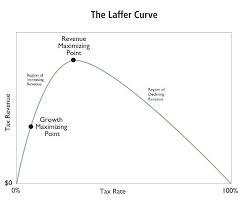

That’s the message in President Obama’s budget for fiscal 2014, which for the first time proposes to cap the amount Americans can save in these tax-sheltered investment vehicles. The White House explanation is that some people have accumulated “substantially more than is needed to fund reasonable levels of retirement saving.” So Mr. Obama proposes to “limit an individual’s total balance across tax-preferred accounts to an amount sufficient to finance an annuity of not more than $205,000 per year in retirement, or about $3 million for someone retiring in 2013.”

That’s the annoying thing about the Left; they just feel they know all about “fairness”. See, it’s not fair that someone retire with more than a certain amount.

And why?

Because, the Barackness Monster knows best.