Barack Obama’s Weekly Radio Address

February 21, 2009

Earlier this week, I signed into law the American Recovery and Reinvestment Act — the most sweeping

Sweeping is a word. Not the one I would have picked, but, hey, who am I?

economic recovery plan in history. Because of this plan, 3.5 million Americans

How do you know? Where did you get this number? 3.5 million…..

will now go to work

This is tricky of you Mr. Chairman! Very very tricky. You make it sound like these 3.5 million, of which 3.5 million are unemployed, will go to work. Now. Gotta hand it to ya sparky, sure got the Chicago style down pat, dont’cha?

doing the work that America needs done.

I’m grateful to Congress, governors and mayors across the country, and to all of you whose support made this critical step possible.

Lot less of them that ya thought, though, huh? All this hope and change? Yeah, me either.

Because of what we did together, there will now be shovels in the ground, cranes in the air, and workers rebuilding our crumbling roads and bridges, and repairing our faulty levees and dams.

Those things, those things should have been being done ANYWAY!!!

Because of what we did, companies — large and small — that produce renewable energy can now apply for loan guarantees and tax credits and find ways to grow, instead of laying people off; and families can lower their energy bills by weatherizing their homes.

Blink. Blink. Weatherize our homes? Next you’ll be tellin’ me to inflate the tires on my car! Hahahah–wait, what? You already said that? Oh my.

Because of what we did, our children can now graduate from 21st century schools and millions more can do what was unaffordable just last week — and get their college degree.

Whoa whoa whoa sparkey. More money in the schools ain’t what keeping kids from graduation. You got that!?

Because of what we did, lives will be saved and health care costs will be cut with new computerized medical records.

Awesome idea. Really really is. But not stimulative. Just not. Write it up in a bill and pass it. But don’t lie to me. Change my ass.

Because of what we did, there will now be police on the beat, firefighters on the job, and teachers preparing lesson plans who thought they would not be able to continue pursuing their critical missions. And ensure that all of this is done with an unprecedented level of transparency

Cough —bullshit— cough. You didn’t even let Republican LAWMAKERS in the room when this was written. You SAID daylight. 5 days. For us to see. Transparency. “I don’t think that word means what you think it means!”

and accountability,

Right. Forgive the disbelief.

I have assigned a team of managers to make sure that precious tax dollars are invested wisely and well.

Right. Forgive the disbelief.

Because of what we did, 95 percent of all working families will get a tax cut — in keeping with a promise I made on the campaign.

This one you keep? THIS one? Awesome you “non tax cutter”

And I’m pleased to announce that this morning, the Treasury Department began directing employers to reduce the amount of taxes withheld from paychecks — meaning that by April 1st, a typical family will begin taking home at least $65 more every month. Never before in our history has a tax cut taken effect faster or gone to so many hardworking Americans.

But as important as it was that I was able to sign this plan into law, it is only a first step on the road to economic recovery.

Aaaahhh, here comes the punchline.

And we can’t fail to complete the journey. That will require stemming the spread of foreclosures and falling home values, and doing all we can to help responsible homeowners stay in their homes, which is exactly what the housing plan I announced last week will help us do.

Serious?!? Are you F$%#ckin’ KIDDING me? Do you read the papers? Do you READ what is going on? Do you have a CLUE as to what got us in this mess? Home ownership? Come on man! Stay out of the way. Let the market clear.

It will require stabilizing and repairing our banking system, and getting credit flowing again to families and businesses. It will require reforming the broken regulatory system

Google “Mark to market” you regulatory guy you.

that made this crisis possible, and recognizing that it’s only by setting and enforcing 21st century rules of the road that we can build a thriving economy.

And it will require doing all we can to get exploding deficits

HAHAHAHAHAHAHAHAHAHAHAHA. Breath. HAHAHAHAHAHAHAHAHHAHAHA.

Thank you.

under control as our economy begins to recover. That work begins on Monday, when I will convene a fiscal summit of independent experts and unions, advocacy groups and members of Congress, to discuss how we can cut the trillion-dollar

Pssst. It’s now well over 3 trillion on it’s way to 7.

deficit that we’ve inherited.

It was the Senator YOU that gave this heapin pile of shit to the Blessed Leader you that is now talkin’ about it! Dude.

On Tuesday, I will speak to the nation about our urgent national priorities. And on Thursday, I’ll release a budget that’s sober in its assessments, honest in its accounting, and lays out in detail my strategy for investing in what we need, cutting what we don’t, and restoring fiscal discipline.

No single piece of this broad economic recovery can, by itself, meet the demands that have been placed on us.

This I agree with. Nothin you do is gonna do the trick!

We can’t help people find work or pay their bills unless we unlock credit for families and businesses. We can’t solve our housing crisis unless we help people find work so that they can make payments on their homes. We can’t produce shared prosperity without firm rules of the road, and we can’t generate sustained growth without getting our deficits under control. In short, we cannot successfully address any of our problems without addressing them all. And that is exactly what the strategy we are pursuing is designed to do.

None of this will be easy. The road ahead will be long and full of hazards. But I am confident that we, as a people, have the strength and wisdom to carry out this strategy and overcome this crisis.

Careful. We elected a no name Senator with zero experience and a past history of foolish policies.

And if we do, our economy — and our country — will be better and stronger for it.

Thank you.

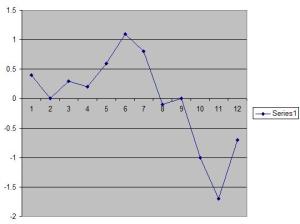

Notice that I have changed the graphical representation some. Most graphs of the CPI show the % change from the month prior, in that case, the graph looks like this:

Notice that I have changed the graphical representation some. Most graphs of the CPI show the % change from the month prior, in that case, the graph looks like this: