I have been making the point that one of the contributors to poverty, income disparity and perhaps income mobility is marriage. I’ve been making the case that marriage tends to bring people out of poverty and failing to get married tends to make one more likely to experience poverty.

For example, I’ve demonstrated that the GINI, or disparity in income, falls as the marriage rate increases in a population:

- 50% Marriage: .3446

- 60% Marriage: .3353

- 70% Marriage: .3227

- 80% Marriage: .3015

As the marriage rate went up, the GINI went down. In other words, as my population increased its marriage rate the inequality diminished. In fact, by moving from a 50% marriage rate to an 80% rate, the GINI moved by 12%.

Let’s do it again. 10,000 new salaries, same constraints:

- 50% Marriage: .3471

- 60% Marriage: .3416

- 70% Marriage: .3248

- 80% Marriage: .3093

Again, a continuing trend toward equality.

As the population marries, the GINI falls. And this is just a mathematical observation, it has nothing to do with the social benefits that occur due to marriage.

Further, data from the Urban Institute and American University shows that marriage impacts poverty in more concrete ways:

The gains from marriage extend to material hardship as well. About 30 percent of cohabiting couples and 33-35 percent of single parents stated that sometime in the past year they did not meet their essential expenses. These levels are twice the 15 percent rate experienced by married parents. Even among households with similar incomes, demographic and educational characteristics, married couples suffer fewer serious material 21 hardships. Moreover, despite their less promising marriage market, low-income and less educated mothers who are married experience significantly less material hardship than low income,

less-educated mothers not married.

Marriage retained an advantage in limiting hardship even among families with the same incomes relative to needs. The variables used for controlling for the effect of income to-needs ratios were the income-to-needs ratios in the current wave of SIPP (the prior four month period) as well as the mean level and the stability of income-to-needs ratios during the 28 months prior to the current wave. Not surprisingly, higher current welfare ratios, higher past welfare ratios, and lower instability of welfare ratios were all associated with less hardship. However, the inclusion of the income variables left intact virtually all of the differences by marital and family status.

Families that fit in the same income that are married fare better than families that are not married.

The other day I posted on poverty and how to avoid it. One of the key barriers to middle class is not getting married:

The Immediate Prerequisites to Success Are:

- Receive a good education [graduate high school]

- Work full time

- Marry [And do it before having kids]

But do we have data? Have we been able to demonstrate that marriage is a determining factor?

Yes. There is data that backs up the idea that marriage, and just marriage, would reduce our poverty rate significantly:

Economists Isabel Sawhill of Brookings and Adam Thomas of Harvard have conducted a fascinating analysis of whether higher marriage rates would reduce poverty in the United States.4 Employing statistical modeling, they analyzed data from the Census Bureau to determine how poverty would be affected if poor people behaved differently. In particular, they modeled the effect on poverty rates of more work, more marriage, more education, and fewer children by poor adults. In the case of marriage, they simply matched unmarried people by age, education, and race until the marriage rate for the nation equaled the marriage rate in 1970. This exercise showed that if we could turn back the clock and achieve the marriage rate that prevailed in 1970, poverty would be reduced by well over 25 percent.

Impressive indeed. Simply returning to 1970 rates of marriage, we would be able to realize a significant improvement in our poverty numbers. And to put this in perspective, social welfare programs aren’t even close when it comes to effectiveness:

By way of comparison, doubling cash welfare would reduce poverty by less than one-third as much as increasing marriage rates.

We could double spending and reduce poverty. But it would only be one-third as effective as getting people to get married.

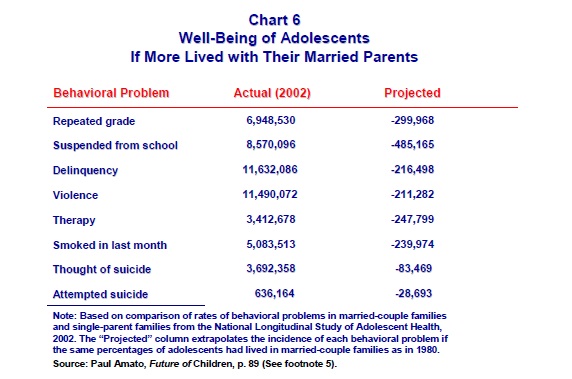

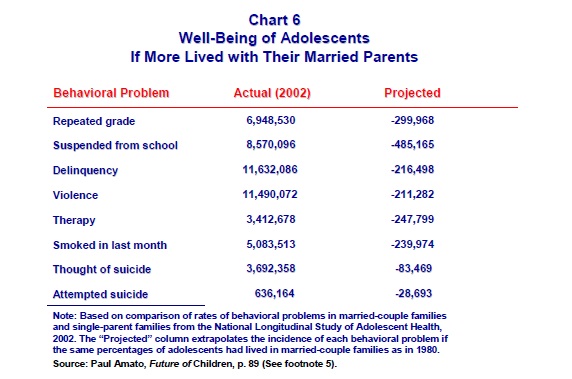

And as a way of comparison, look at the impact of poverty on kids and what reducing that impact by getting married would do:

Marriage, and the declining marriage rate, is a key to poverty in the United States.

Marriage, and the declining marriage rate, is a key to poverty in the United States.

There is little doubt that the Occupy Wall Street crowd was supposed to be the Democrat, the liberal, answer to the Tea Party. However, in typical leftist fashion the movement demonstrated that it is undisciplined, unlawful and unruly.

There is little doubt that the Occupy Wall Street crowd was supposed to be the Democrat, the liberal, answer to the Tea Party. However, in typical leftist fashion the movement demonstrated that it is undisciplined, unlawful and unruly.