Entitlement Programs

The welfare state is a divide between the Liberal and the Conservative. In fact, it’s one of the main fault lines that defines the two ideologies. Imagine what could be accomplished if the two sides would try and come together.

1. It would take the right to acknowledge that there is a place for a safety net for the nation.

2. It would take the left to treat the problem in the same way that organizations treat problems.

First, we have to admit and acknowledge that there are folks living around us who, through the normal vagrancies and winds of life, find themselves in need. Little or no money, food is a struggle and a home safe from the elements is a luxury. For the spiritual, our faith calls us to come to the aid and assistance. For others, it isn’t a matter of faith, it’s simply the mark of a moral and caring human being.

Regardless of how you get to the conclusion, the reasonable individual wants to help those in need.

The Divergence.

There are three aspects of the programs that, in my mind, create and fuel the differences between the two sides. They are:

- How do we measure

- Do they end

- Are they moral and consistent with the concept of Liberty

The first divide is crucial in my mind. Given that we are all invested and wanna help, it now becomes important to identify strategies that work and separate them from the ones that don’t. In my world, failing ideas are shut down and thrown away allowing the resources engaged in those activities to be re-purposed into the programs that DO work.

Too often in the public sector a certain dogma exists within the programs creating an element of “faith” that becomes personal and results in long time failing programs to continue. And, perversely, it is never admitted that the program isn’t working. Rather, the argument is made that not enough money has been funneled to the failed attempt. This creates the very undesirable effect of funneling more and more money to the absolute worst ideas.

The second difference between the right and the left is the concept that, while life does present difficulties in ratios that can be difficult to manage, at some point the individual must assume responsibility for himself. That is, any program designed to provide a “hand-up” must, by definition, end.

Period.

And the program needs to be built with that in mind. Not only in its funding structure but in its charter goal. Consider unemployment. I can buy the argument that we should provide benefits. [though I wash that unemployment insurance could be managed privately] But the program must have a defined end date after which the individual leaves the program and is allowed to manage his own life again.

This isn’t just from a funding perspective, as I mentioned, but as a design element. As part of the unemployment program, we should ask ourselves when designing it, “what is going to happen to Pino when the time is up? Will we have prepared him or life without benefits?”

If those questions aren’t answered and addressed, we’ve not helped the man but rather delayed the inevitable condition of permanent joblessness.

Last is the concept of morality or of Individual Liberty.

I love seeing those cute pictures on Facebook from my Liberal friends. The ones where Jesus is commanding us to feed the poor and care for the sick. The message, obviously, is that programs like food stamps and Obamacare are explicitly our obligation.

I’ve always thought them funny though. Because while we are required, as decent caring human beings, to care for others, the whole concept is that WE care for the less fortunate. It was never assumed that I would take money from my neighbor to the West and give it to my needy neighbor to the East.

In other words, while government necessarily requires the concept of a tax, there comes a time when the confiscation of wealth for my own charities shifts from proper and necessary government to theft. No one would think it moral if 3 people to vote to “tax” of their companion’s money.

I would leave you with this. By failing to address issue 1 we are left with a system that cannot handle issue 2. And now it becomes a horse race every election to draw the line in issue 3. The result?

Julia’s Mother. A citizen who comes to the very rational conclusion that the perverse system has created incentives that are not normal:

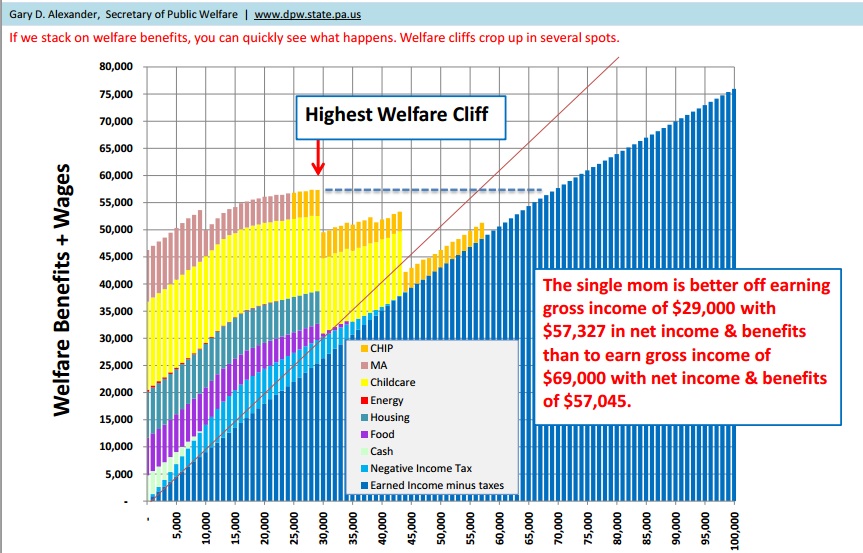

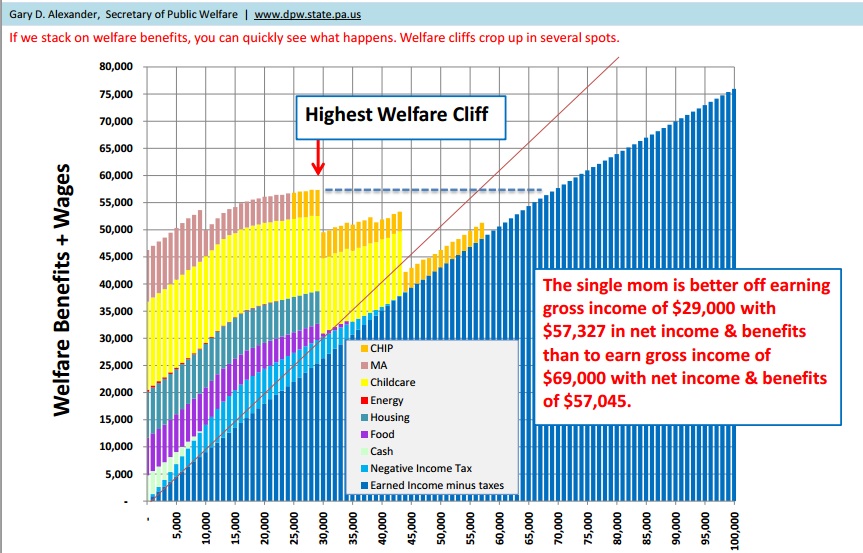

The U.S. welfare system sure creates some crazy disincentives to working your way up the ladder. Benefits stacked upon benefits can mean it is financially better, at least in the short term, to stay at a lower-paying jobs rather than taking a higher paying job and losing those benefits. This is called the “welfare cliff.”

Let’s take the example of a single mom with two kids, 1 and 4. She has a $29,000 a year job, putting the kids in daycare during the day while she works.

As the above chart – via Gary Alexander, Pennsylvania’s secretary of Public Welfare — shows, the single mom is better off earning gross income of $29,000 with $57,327 in net income and benefits than to earn gross income of $69,000 with net income & benefits of $57,045.