I continue to question the GINI calculation comparison of nations in order to determine how well wealth is distributed within those nations. For example, I have a specific problem with the fact that the United States has seen a significant rate of marriage decrease in its population over the last several decades.

As an example, I used a population of 4 and computed the GINI if they were all single:

24,000 – 30,000 – 50,000 – 75,000 The GINI came to .24162

If we marry 2 of those we might see:

24,000 – 50,000 – 105,000 This GINI is .301676

If we marry a different 2, we might see:

54,000 – 50,000 – 75,000 This GINI is .093110

Clearly the makeup of the population impacts the GINI coefficient. In this analysis, I was called on small sample size. Fair enough. I did the data on a population of 10,000.

I took a random sampling of 10,000 salaries. These salaries ranged from $0.00 to $250,000 and formed a near perfect bell curve with an average of $125,000. Clearly this is not how wealth is distributed in real life, but I am simply making a point.

I then created 4 worlds. Each world had a different marriage rate; 80-70-60-50%. An acknowledge flaw in my data is that I do not randomize the single people each time. That is, in the first world where 80% of the population is married, I take the first 2,000 and mark them single. I then marry the 2001st individual to the 6,001st individual. Then the 2002nd individual to the 6,002nd individual and so on.

My results:

- 50% Marriage: .3446

- 60% Marriage: .3353

- 70% Marriage: .3227

- 80% Marriage: .3015

As the marriage rate went up, the GINI went down. In other words, as my population increased its marriage rate the inequality diminished. In fact, by moving from a 50% marriage rate to an 80% rate, the GINI moved by 12%.

Let’s do it again. 10,000 new salaries, same constraints:

- 50% Marriage: .3471

- 60% Marriage: .3416

- 70% Marriage: .3248

- 80% Marriage: .3093

Again, a continuing trend toward equality.

Does my theory have legs in the real world? I think it does:

Inequality is typically higher as the percentage of married people declines and as the correlation of of partner’s income increases. Inequality also tends to be higher when low-income earners are disproportionately likely to remain unmarried.

In other words, the more people marry, the more equitable income is. Especially when this trend is observed in low income individuals.

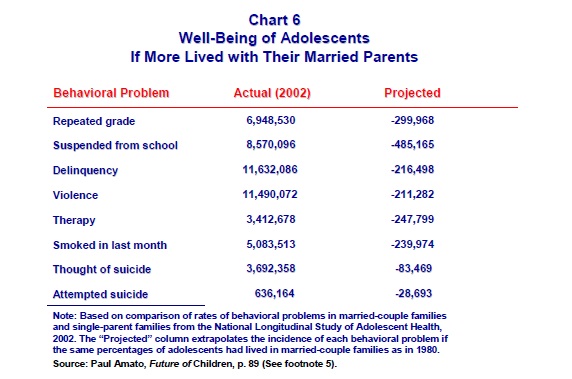

Further data suggests that poverty is addressed by marriage:

As expected, the results clearly show that married parents experience lower poverty rates and higher incomes not only than single mothers living without another adult, but also among those unmarried mothers with at least two potential earners. Poverty rates of cohabiting couple parents are double those of married parents; non-cohabiting single parents with at least a second adult had poverty rates three times as high as among married parents. The apparent gains from marriage are particularly high among black households.

The gains from marriage extend to material hardship as well. About 30 percent of cohabiting couples and 33-35 percent of single parents stated that sometime in the past year they did not meet their essential expenses. These levels are twice the 15 percent rate experienced by married parents. Even among households with similar incomes, demographic and educational characteristics, married couples suffer fewer serious material 21 hardships. Moreover, despite their less promising marriage market, low-income and less educated mothers who are married experience significantly less material hardship than lowincome,

less-educated mothers not married.

In short, marriage matters. And for whatever reason, the United States is becoming a less married nation. If you wanna address poverty, inequality and hardship, focus on getting people, especially low-income people, married. Failing that what you are doing is transferring wealth from one population to another in an attempt to “wish” you way out of reality.