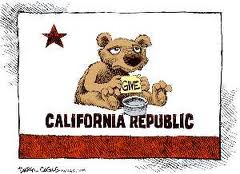

California is broke. Way broke. And spending is the problem. So what did California do? They enacted new laws calling for new taxes on the rich:

The big state tax news is that California voters said to sock it to the rich–specifically those with income of $250,000 and up. California Proposition 30, which Gov. Jerry Brown’s budget and public education in particular depended on, passed.

Proposition 30 creates three new upper income tax brackets for the next seven years. For example, folks with $250,000 to $300,000 a year in income will pay 10.3%, up from 9.3%. The new top income tax rate–for folks with income of $1 million-plus–will be 13.3%, up from a current top rate of 10.3%. That eclipses New Yorkers’ combined state and local top rate of 12.7% and Hawaii’s top rate of 11%. The income tax hikes are retroactive to Jan. 1, 2012, but the extra bill isn’t due until April 15, 2013.

The expected result? Well, if past results can predict future ones, I would expect that California sees more people leaving:

Nearly four million more people have left the Golden State in the last two decades than have come from other states. This is a sharp reversal from the 1980s, when 100,000 more Americans were settling in California each year than were leaving. According to Mr. Kotkin, most of those leaving are between the ages of 5 and 14 or 34 to 45. In other words, young families.

…

Meanwhile, taxes are harming the private economy. According to the Tax Foundation, California has the 48th-worst business tax climate. Its income tax is steeply progressive. Millionaires pay a top rate of 10.3%, the third-highest in the country. But middle-class workers—those who earn more than $48,000—pay a top rate of 9.3%, which is higher than what millionaires pay in 47 states.

People aren’t gonna put up with it; they aren’t going to continue to work harder for less, pay more for smaller houses and face ever increasing costs associated with energy and transportation.

The Laffer Curve wins again.

Side bet – I bet in ten years California’s economy will be doing really well, and Gov. Brown will be praised for how he saved California again (he also rescued it after the economy was mismanged by his predecessor back in the 70s — though the mess Reagan left then wasn’t as difficult). Also, note that California’s state debt is less than those of many states as a percentage of GDP. 26 states have higher state debt compared to the size of their economy. Claims of California being like Greece or suffering economic collapse are way overblown.

So – we’ll meet some point in ten years, I’ll buy you and yours a great dinner and all the booze you can drink if California is still a mess, you’ll buy me the same if they’ve bounced back? Care to make that bet?

So – we’ll meet some point in ten years, I’ll buy you and yours a great dinner and all the booze you can drink if California is still a mess, you’ll buy me the same if they’ve bounced back? Care to make that bet?

Deal.

Though I keep looking for reasons to travel to Maine; I’ll buy ya dinner if I ever get up that way.

Caleefornia reminds me of the Spanish Empire of the 16th and 17th Centuries . It is potentially the richest State of the 57 . Spain back in the day had immense treasure coming in from the Americas . In both cases financial mismanagement and corruption were and are rampant . If you have enough cash flow, you can borrow to survive outright stupidity for a very long time .

There was an article in the Wall St. Journal about Silicon Valley abandoning Government subsidized Green Energy start ups . At least one part of California is becoming smarter . It’s a real shame Gov. Brown is not .

Sorry I’m a little late to this conversation, but most of this flight of young families is due to Proposition 13, a measure passed in the late seventies that “sets the value of properties at the time of purchase, with a possible 2% annual assessment increase. Therefore, properties of equal value have a great amount of variation in their assessment, even if they are next to each other.” In other words, it’s a regressive tax since younger (and by definition) poorer families pay a disproportionate share of property taxes. For instance, I bought my house right after the financial crisis, when prices had declined by 30%+, yet I still pay 40-50% more than my neighbors do in property taxes, solely because they purchased in the mid-nineties.

Sorry I’m a little late to this conversation, but most of this flight of young families is due to Proposition 13

That sounds rather crazy. However, do property taxes flow into the state or the county or the city?

They flow into the county, I believe. At least that’s who I personally write the check to.

They flow into the county, I believe.

Strange that a state law would describe county taxes.

Either way, yes, the flight of California folks has been the young families.

Too bad, California could be such a great place.

California has to be allowed to fail . It will fail, but because of it’s political clout it may get a GM style bailout . It’s a tragedy because there are still parts of it that are worth saving . The other tragedy is that many Liberals are leaving along with the productive people and they are infecting the surrounding States .

Some good news: California has balanced its budget and is projecting surpluses!

http://www.nytimes.com/2013/01/11/us/california-balances-its-budget.html?_r=0

Some good news: California has balanced its budget and is projecting surpluses!

If the revenues and the economic indicators are realized, this is great news! Chalk one up to austerity!

Second time Brown has had to make cuts and try to right California’s path. He had inherited similar but less extreme problems in the 70s from Gov. Reagan. I’d personally like to see him run for President in 2016, but he’s too old.

Second time Brown has had to make cuts and try to right California’s path.

If he does it, good on him!

And other states, and the feds by the way, ought to take a look at what he cut and how.

Now, to tackle California’s debt!

Truly amazing news for a state with $ 617 Billion in unfunded liabilities, including $ 398 Billion in unfunded pension liabilities . Or should I say Amasing . Projections are wonderful .

Don’t forget, these projections also bake in a massive tax hike for any Californian making over $250k. The super wealthy (the group that will be hit disproportionately by this tax hike) are the ones who can easily afford to leave the state – and many will.

The super wealthy (the group that will be hit disproportionately by this tax hike) are the ones who can easily afford to leave the state – and many will.

Indeed.

The Laffer Curve will not be denied!

😉

The Laffer curve isn’t about people leaving (and most people won’t leave due to a small tax increase – the cost of moving, getting a new job, setting things up , taxes elsewhere, etc. is very high). The Laffer curve is about at what point do tax increases hurt the economy to the point that it leads to revenue decreases. California and the US are nowhere near that point. Also, don’t forget that spending cuts have an even stronger negative impact on the economy (stronger because usually that’s money taken directly out of the economy — money from tax cuts are just as likely to be spent on foreign goods or to pay down debt). I’m not saying that there doesn’t need to be spending cuts – we do need to get debt under control. But revenue increases via taxes are not worse for the economy than spending cuts.

I am confused, is it me or do the following comments contradict with one another ?

” Also, don’t forget that spending cuts have an even stronger negative impact on the economy (stronger because usually that’s money taken directly out of the economy — ”

” Second time Brown has had to make cuts and try to right California’s path. ”

Has Governor Brown righted California’s path ? We shall see . How could he have done it with spending cuts, if spending cuts negatively impact the economy ? If he did do it and it works , why can’t President Obama ?

Fair enough, we’ll see how this plays out over time.

Spending cuts do hurt the economy, but structural budget deficits hurt it more. Tax increases do hurt the economy but structural budget deficits hurt it more. That’s the dilemma here. Given how in recent years the upper income earners have benefited the most (their wealth and income has grown considerably) while middle and lower class have not (their incomes have stagnated), asking the wealthiest to pay a bit more is only common sense.

Here’s what’s happening – technology has improved productivity and allowed companies to increase profits with less labor. That means workers are not as needed (or valuable) but profits are going up. The money goes to the share holders and top executives, while workers are in a tougher situation. There should be some way to assure that the benefits of technology and higher productivity aren’t focused on just the wealthy.

Scott,

I really would rather be totally wrong and have to buy you a meal with expensive booze, but this is why I have my doubts .

http://www.latimes.com/news/local/la-me-state-debt-20130114,0,3244487.story