I suspect that even pedestrian news watchers have heard of the fiscal cliff by now. I hold out very little hope, however, that even a basic understanding of what that means is had. Which, I suppose, is par for the course.

However, here on the hallowed pages of TarHeel Red, it means that the federal government has some decisions to make. We could, for example, go off the cliff. Some think that not such a bad idea. Me, for example. I think that taking the hard steps required to cut spending, even defense spending, are long past due. Sadly, I’m joined in this analysis by Hoard Dean. I’m suspicious of the twist of fate that cause him to agree with me; I’m afraid to discover which of us has made the mistake in calculus.

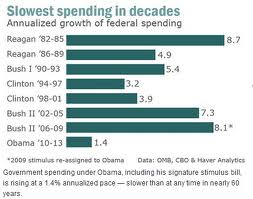

However, there are other courses to take. We could make permanent the Bush era tax cuts. For everybody. For some. We could take this opportunity to cut spending even more, maybe even in a REAL way that real Americans understand. For example, the local specialty beer shop around the corner sells individual bottles of goodness for $2 American. I like to stop in and buy a six-pack every other week. My spend is $24 a month.

But let’s say that I budget an increase, I want to not only buy those 2 six-packs a month, but I wanna add the full liter of specialty beer. I up my spend from 24 bucks to $31. But then….then, well, Obama wins the election and my financial adviser says that I should cut back, so I say, “Okay.” And instead of buying 12 beers a month I buy 14; an extra $4.

My man goes crazy, he’s out of his head crazy. He demands to know how I agreed to cut the amount of money I spend on beer and THEN expanded it. I tell him simple, “I had budgeted a $31 expenditure. I reduced it to $28. I cut out nearly 10%!”

Serious. Politicians, all of ’em, dem and repub, look us in the eye and say this with a straight face.

Anyway. The cliff.

Obama wants to raise the rate of taxation on the rich. And when he says that, he means the rate of federal income tax. He frames the question in terms of the federal income tax rate. So, I usually speak about the federal income tax rate. And this is what I say:

According to the CBO, in aggregate, the poorest 60% of us don’t pay a federal income tax. Worse, the top quintile, the wealthiest 20%, pay more than 94% of federal incomes taxes according to the most recent numbers in 2009.

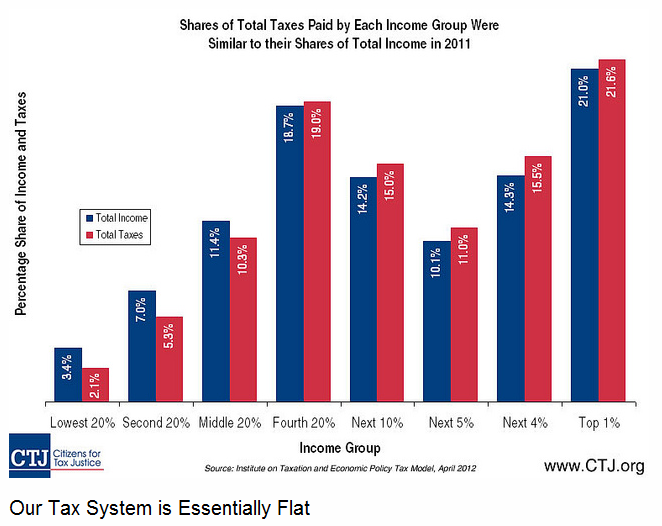

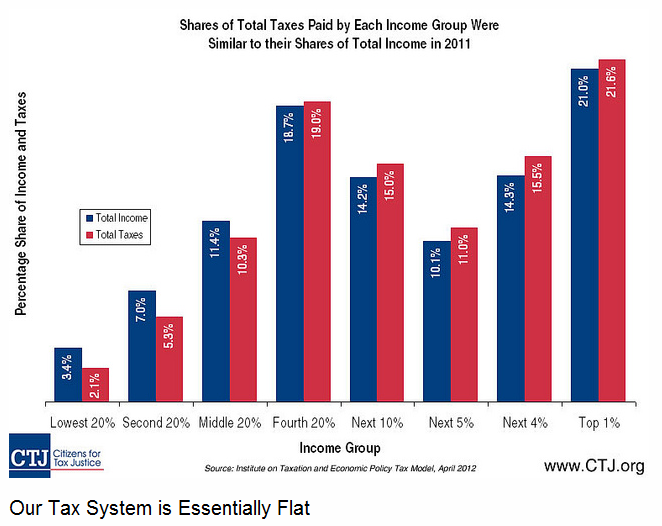

When Obama claims that the rich don’t pay their fair share, he’s not making sense. The rich are paying dramatically more than their fair share. However, I have folks that disagree with me. And those that do point to this graph:

This graph, built by Citizens for Tax Justice, shows that as a % of income, we all typically pay about the same share of taxes. For a time I couldn’t square the data. The report from the CBO didn’t seem to jive with the data coming from CTJ.

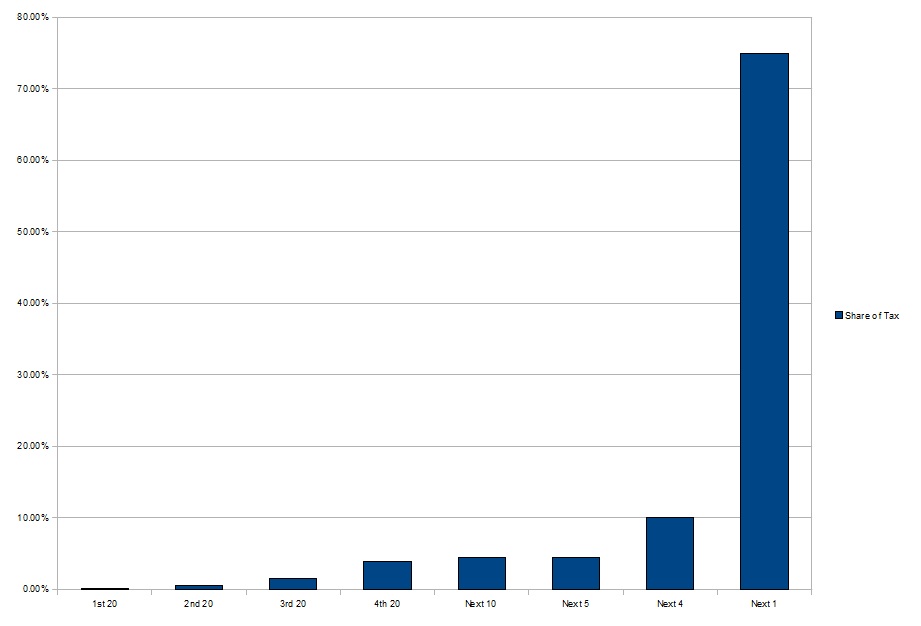

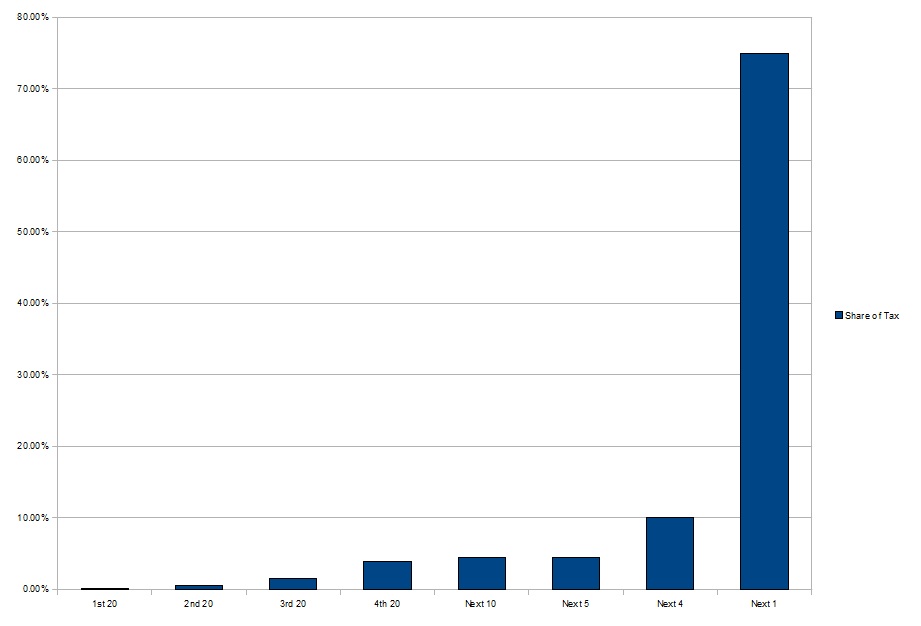

Then I realized my mistake. We’re talking about two different units. The CBO data that I was using was reporting share of tax revenue. The CTJ is using share of income. When I used the “back of an envelope” – I had too, the CTJ data is in 2011 numbers and the CBO data is in 2009. Further, I used the average of the quintiles and not the total population so my numbers may be off. However, if the details can be run, I’d be interested in seeing that. This is what I came up with:

Now we’re talking apples and apples. I broke out the quintiles in that weird way that folks do; listing the first 4 and then breaking down the last by the “nest 10”, “the next 5”, “the next 4” and “the top 1.” What this means is that if you gather than top quintile in one group you would see that they pay 93.93% of all taxes. And this is on an earning of 50.0% of all income.

Holy moly.

The top 20% of Americans earn 50% of the income and yet pay 94% of the taxes.