Money. The spending of it. The making of it. Revenue and expenditure.

How to manage it all responsibly?

Recently, always[?], there has been a debate regarding the deficit and the debt. How we as a nation spend vs how much we as a nation bring in. The most recent event was the fiscal cliff. The new event is the debt ceiling negotiations. And yes, there will be negotiations regardless of what the President says or what he wants.

Leave aside the partisan bickering for a second and let’s just look at this in a way that people kinda get; real world.

Typically, a household has an idea on how much money they bring in. And this amount of money dictates how much they spend, typically. In college I brought in very little – I spent very little. Out of college I brought in more and spent more. And during these times, my spending would, indeed, fluctuate. I could count on certain bills and expenditures but others would just come up. A broken muffler, a wedding out of state. Maybe dental work.

My budget would often shift. But it was always thought of in relation to how much I could bring in. I knew that I was taking a short term hit but long term gain by going to college. Earnings would suffer but the long term outlook was positive.

But my debt was always defined in relation to MY reality.

Earlier this week, the fellas at Poison Your Mind posted on the fact that the United States is a low tax country:

Of course, one can have a political preference that the US maintain extremely low taxes and/or reduce the size of government, but neither political inclination is compelled by The Math.

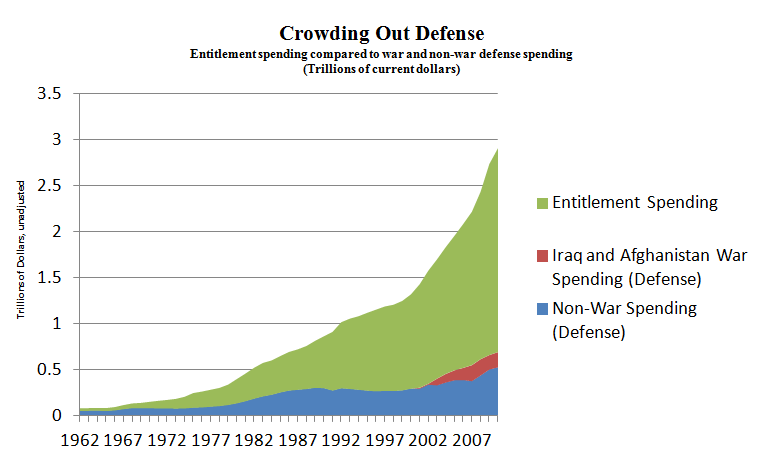

I assume, with all the risks commensurate, that by referencing “The Math” RR is referring to the fact that republicans claim spending is to blame for our deficit, not taxes. In fact, the chart accompanying the post shows that the United States is near the bottom in tax revenue indicating that tax revenue, and not necessarily spending, is the problem.

But to me, that doesn’t jive.

Back to younger me. I existed in my own reality. I went to school, church and lodge with members of my community that existed on a range of socioeconomic status. Virtually ALL earned more than I did. And now, flash forward to today, I exist in that same strata, many peers earn more, many less. None of which have any bearing on defining the health of my financial status.

I must balance my spending with my revenue.

In some cases I earn less due to sheer ability. They have it and I don’t. In other cases it’s based on desire; they have it and I don’t. In others, I earn more because I am the one with the desire or the ability. And yet in others, people have decided that compensation takes forms other than money; time off, value to society and personal growth are examples. Whatever the individual situation is, basing fiscal health on the experience of others is rather short sighted. And in the end, not at all healthy.

For whatever reason, perhaps because we are an independent colony all grown up. Maybe it’s because we have access to massive natural resources. Or education, or – well, whatever. Whatever the reason, America has decided that it only wants to generate “X” amount of revenue. We don’t wanna work harder to earn more per hour, or take an second job. We’re cool where we are.

Given that reality, our spending has to reflect that fiscal reality and adjust. It just has to. And if it doesn’t, then spending is the problem.

But back to the chart, it IS rather stark. After all, we are the United States of America and certainly have reason to expect that we come in better than 4th from the bottom. Am I missing something?

Well maybe.

See, we may only be taxing at a very low rate of GDP, but we are a very VERY rich nation. So, while a person may argue that a policy of higher tax revenue is desirable, the larger question may be ignored. Namely, is the nation wealthier as a result of such taxation or less wealthy as a result.

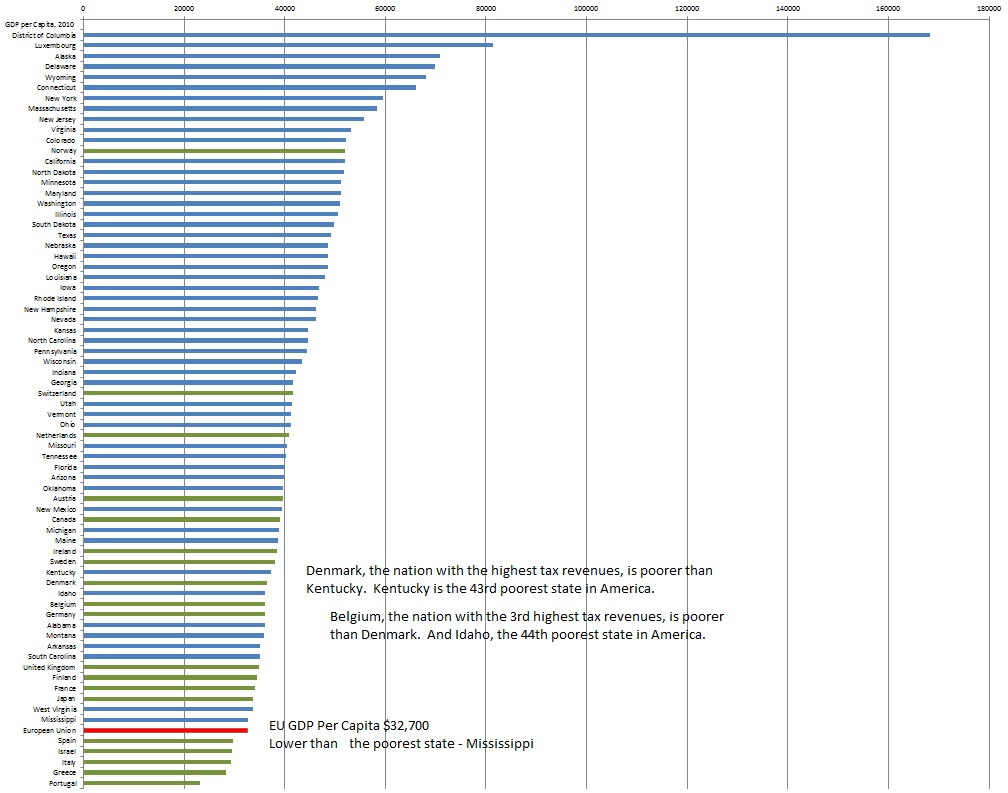

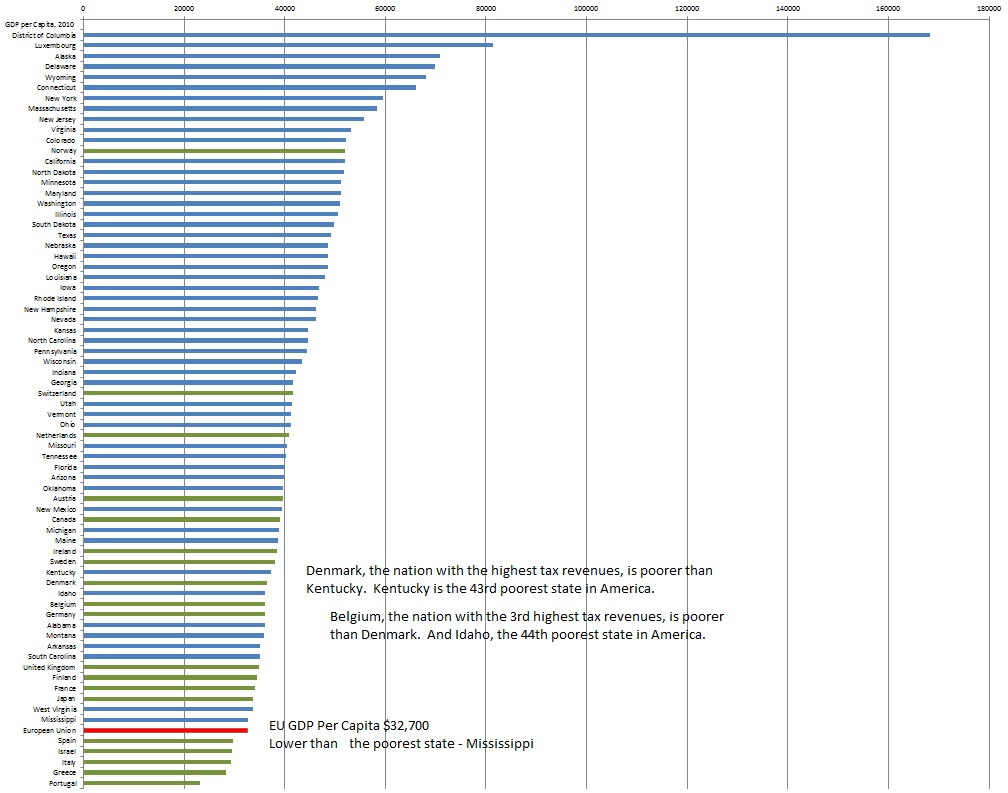

There is data:

It turns out that America does well compared to her high tax peers. For example, Denmark, the nation with the highest revenues, is very poor compared ti the states of the United States. In fact, if Denmark WERE a states, it would rank only as the 44th richest state in the Union. Behind Kentucky. And Belgium, the nation with the 3rd highest tax revenues? Why, it would rank below even Denmark, poorer even than Idaho.

The EU as a whole, with Spain, Israel, Italy, Greece and Portugal all, ALL, rank lower than the poorest state in our nation; Mississippi.

This might mean that such high tax rates lead to less prosperous nations. Or it might mean that such high tax rates are really an illusion of mathematics – revenues compared to a paltry GDP may seem higher than they really are. Whatever the explanation, I doubt anyone would argue that we would wanna live in a nation that would rank among the poorest of our states.