There’s been a lot of discussion surrounding the mobility between classes here in America. At the same time, there’s been a lot of discussion surrounding the importance of education. Not only getting a high school diploma but on getting a college one as well. In fact, it’s gone so far as to have people calling for free college education for all Americans. The argument is that the rich get richer while the poor get poorer. That income mobility in America is restricted. That attaining wealth is more and more becoming reserved for the pre-existing well to do’s.

For a long time I’ve fought this belief. I’ve fought the idea that America is not the land of opportunity. That we’ve somehow lost the idea that if you work hard enough you can do anything.

I’ve fought it.

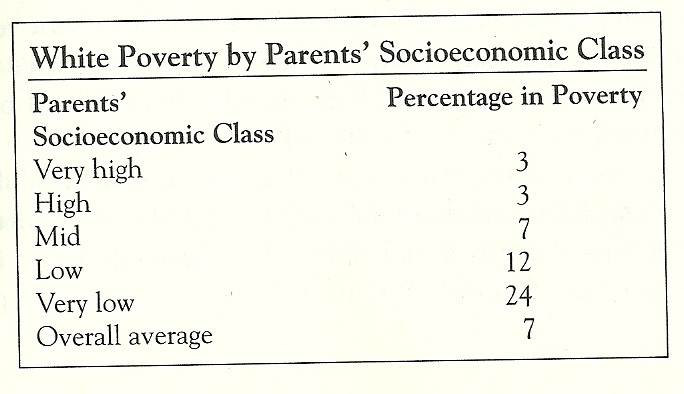

And now I’m reading a book, The Bell Curve, and I’ve seen some interesting data. For example, it seems to be important where you come from if you wanna avoid poverty:

If you’re born to a family with very low socioeconomic class, you have an 8 times better chance to find yourself in poverty than if you were born to a family with a very high socioeconomic status.

If you’re born to a family with very low socioeconomic class, you have an 8 times better chance to find yourself in poverty than if you were born to a family with a very high socioeconomic status.

It would seem that class matters.

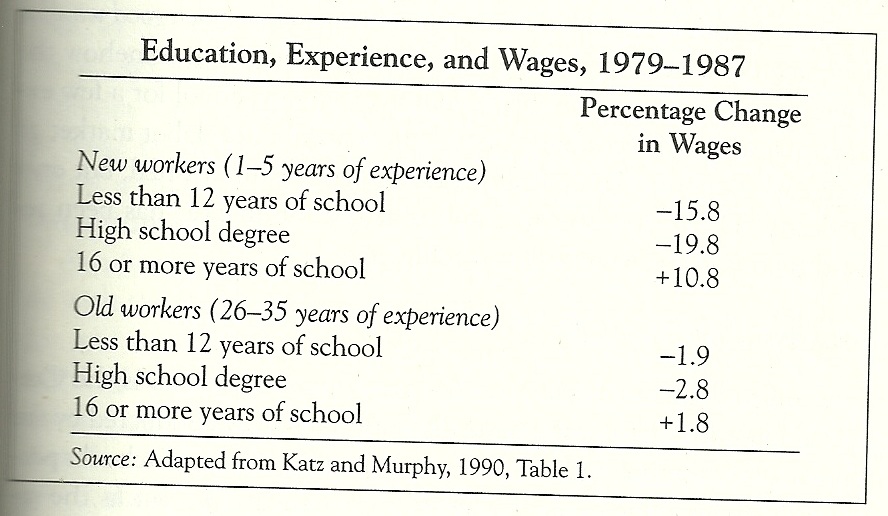

Further, when it comes to wages, the data suggests that there is an education gap that would strengthen the argument that we need to increase college degrees to our kids:

It’s hard to argue the numbers. High school droop-outs are seeing their wages drop by double digits while college graduates are seeing double digit increases.

Interesting data to be sure.