Recently I was part of a small conversation regarding a portion of the tax cuts in the new Stimulus Package. The subject that got us all going was, well, the headline you see at the top of this very post; what 400 bucks is gonna do…. Now, to be clear, I think that what we were talking about was the portion of the tax cuts that President Obama refers to as tax cuts to 95% of working men and women; $500 for an individual, a $1000 for a family. At least that’s what I think the reference is, though, to be fair, I’m not sure. For example, I don’t know where 400 came from, as I mentioned, I though the Obama tax cut was $500…anyway, I digress. The point is, we had a good conversation.

Here is my case.

The Federal government levies taxes on individuals in the form of individual income tax. As far as I know, there are no other taxes on individuals that the Feds have claim to. Sales tax is a state tax, state income tax is, well, levied by the state. Vehicle, property, city and county taxes…all non-Federal. FICA and Medicare, not taxes. These are with holdings that fund programs or specific funds. They can not be used for other purposes, and if those programs or funds went away, so too, would the withholding. FICA , after all, is is really just shorthand for Federal Insurance Contribution Act. In this specific case, Social Security is really just an insurance program. Anyway, point is–not a tax.

That would mean, for the Federal government to say that it is giving a tax cut to 95% of working Americans, he would have to reduce the rate of the tax. For example, if an individual is being taxed at 28%, to realize a tax cut, she would have to see her rate go down, say..to 27% or 20%. That’s a tax cut. What is not a tax cut is when an individual who currently pays no amount of money to the Federal government gets a check from Uncle Sam. It is something. And if it’s a grand, it’s not insignificant. But what it’s not, is a tax cut.

And this is why it’s important. It’s important because it has clear and critical ramifications, when dealing with a struggling economy. It is NOT important because of the partisan bickering going on. We have all heard the arguments going back to the election from the Democrats that Obama was offering a tax cut and The Republicans claiming it was just income redistribution. That’s not why it’s important. Where it really really matters is in how the recipients SEE, or perceive, the additional money.

You see, when I am chugging along in my normal economic way, I do just that–chug along. I buy near the same kinds of groceries at near the same amounts. I drive about the same kind of car and get it washed at about the as often as I always do. I go out about the same number of nights and have about the same number of beers. But now, let’s say that something changes. Let’s say that I get a check back from my insurance company; my rates went down and they have overcharged me for two consecutive 6-month periods. I get $500. How do I spend that money? It has been shown that the typical person spends it in one of two ways – They pay down debt OR they go on a 1 time splurge shopping spree. So, VISA gets it or Best Buy gets it. And then whamo, right back to the normal way of spending money. Point is, there is no sustainable economic jolt in either paying off VISA or buying that flat screen TV.

Now, let’s say that instead of a windfall [the insurance overcharge check], I get a raise. This presents me with a new way of looking at the money coming into me. I view this a sustainable income, an item that I can budget for and count on. I know it’s going to be there next paycheck and the paycheck after it. This affects my spending in a much different way. It sustains it. I am more willing to up what I buy and/or how often I buy it. I may not ration myself to a 6-pak. Perhaps I can up how often I get a new car, or new jeans or new whatever. Further, because it is not presented to me in a lump sum significant amount, the chances that I sink it into debt reduction is less; I actually spend it. In this case, the economy is better off.

Now, for the whammy. If, instead of giving me, a worker bee who concerns himself with just me and mine, a $500 bump, what if 20 people like me DIDN’T get the money but it went to a small business owner who was just thhhhiiiiiiisss close to obtaining the money to hire one more guy. Or buy that new processor in his assembly line. What if that 10k went to someone who GREW the money, who took it and turned it into 15k, or 20k AND gave someone a job because of it?

It is because of these reasons that fiscal conservatives don’t like the tax cut language in the stimulus package. Not because Obama thought of it, or because Pelosi pushed it. Or because no republican voted for it. It’s because it’s moving money around in a way that does not grow said money, and it denies the recipient the critical perception that it’s sustained. And further more, if you want to grow the economy, it’s not putting it into the hands of people who grow money.

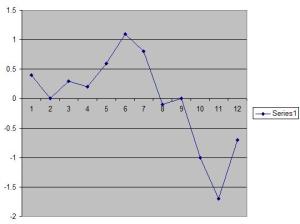

Notice that I have changed the graphical representation some. Most graphs of the CPI show the % change from the month prior, in that case, the graph looks like this:

Notice that I have changed the graphical representation some. Most graphs of the CPI show the % change from the month prior, in that case, the graph looks like this:

If you dial the Way Back Machine to the year 1980, specifically May of 1980, you will be looking 68 straight months of unemployment higher than 7.0%. Imagine! Imagine having to go through the last two months for most of 6 years! In fact, there were 78 months above 7.0% missing only one which came in at 6.7% And to make it even worse, at the height of it, the rate stood at 10.8%. Almost 11%.

If you dial the Way Back Machine to the year 1980, specifically May of 1980, you will be looking 68 straight months of unemployment higher than 7.0%. Imagine! Imagine having to go through the last two months for most of 6 years! In fact, there were 78 months above 7.0% missing only one which came in at 6.7% And to make it even worse, at the height of it, the rate stood at 10.8%. Almost 11%.