So, it took, literally, 3 business minutes for our financial planner to e-mail us the morning after the election. He suggested that we talk, asap, in order to adjust our portfolio.

The call occurred this morning and this is the takeaway:

- We immediately stopped the auto investment of equities that rely on Capital Gains and Dividends. The money that was designated for such investments will now be routed to cash

- Begin the auto investment of purchasing municipal bonds.

- Develop a plan to determine how much of our cash position should be allocated to those muni’s in a lump sum purchase.

- Develop a plan to determine how much of our equity position should be sold to protect our risk to the market.

- Review the household budget and identify the cash flow impact of maxing out 401k contribution.

- Initiate a tax exposure picture at key levels of income.

- If our salary hits a level that triggers negative tax implications strongly consider giving the money away to reduce our taxable income to more favorable conditions.

- Consider acceleration of retirement. In essence, negotiate a more work/life balance friendly role at the office in exchange for less money/salary. Enjoy life more and stress less while maintaining the ties to the corporation until such time as a higher income is better protected.

The advice was jarring. The analysis was clear, direct and immediate. The market’s reaction to the election was negative and complete. Investors all over America were having conversations just like this one. A massive sell off is underway with people moving money out of equities and into safer tax free vehicles like the bonds mentioned above.

Or just getting the hell out of the equities and sit on the cash. And wait.

And that wasn’t the most chilling advice, that came in the later recommendations. The first was somewhat humorous and carried an element of a gut reaction:

If the government is going to take 40% of your property move out of the way of that and just give the money to your favorite charity.

Seriously. Just give it away. The thinking is that I’m really only out 60 cents on the dollar and the charity is much more efficient at handling the money than the federal government of the United States.

But it was the third piece that really got me. The advice was to “Go Galt.” Negotiate, in essence, a demotion at the office in order to reduce the salary to a more friendly level and have more time to enjoy the things we might be pushing off or rushing through.

Just quit and walk away.

My wife and I hold jobs that are incredibly specialized. The work we do, the hours we allocate to that work and the degree of competence is exceptional. In the case of my wife I’m simply reflecting fact and you’ll just have to believe me. As far as MY level of expertise goes, some of you may have your doubts based on the content and style of this blog; I don’t blame you that discretion.

If we did leave, the jobs wouldn’t be back-filled; they’d be absorbed. No one would get promoted as a result. The company would be out our production and expertise and the economy would be out the money we now couldn’t spend because we aren’t earning it anymore.

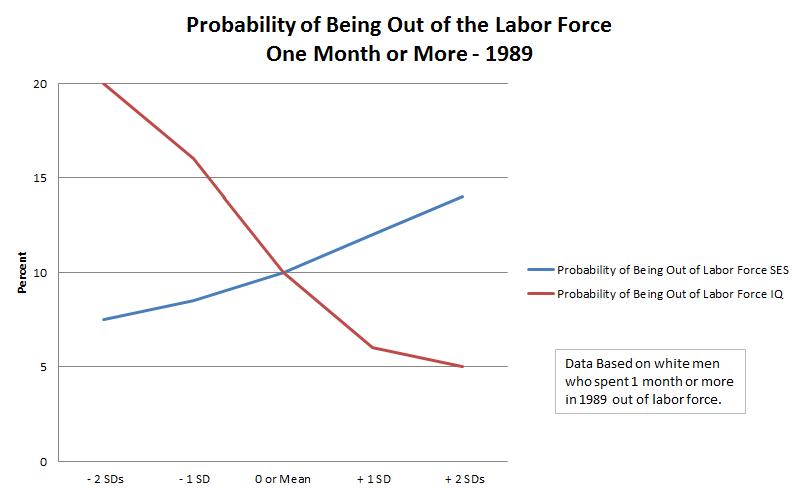

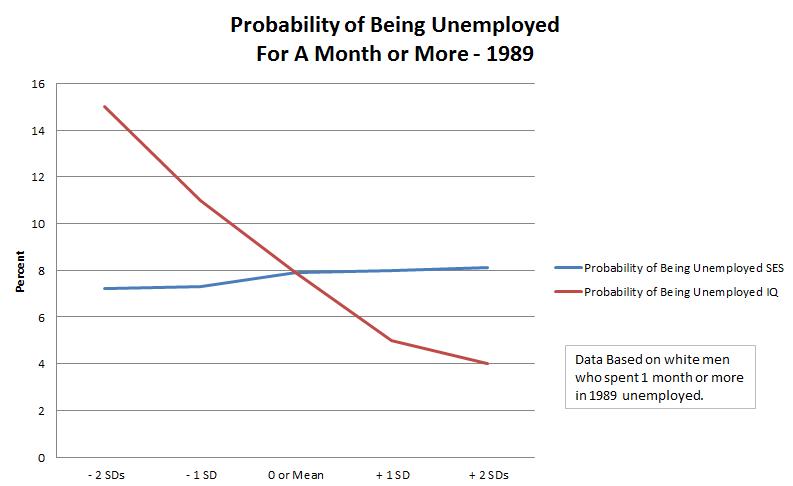

Now, for the Laffer Curve.

Let’s pretend that I’m right smack dab in the middle of the 28% tax bracket. If I double the 401k contribution we make I will reduce my tax exposure by $7,929. That means the government gets $7,929 x 28% = $2,220 LESS than they would have had we not gone and elected this unqualified train wreck of a President.

Not to mention the 28% of the money they lose if I just give it away. Or the 28% they lose if I take a lower salary.

And if I DO increase my 401k contribution that means I’ll have 8 grand a year less to spend on just random stuff here in North Carolina. It’ll mean fewer dinners out at my favorite pizza joint. The BBQ shack down the road? Out my business. Ice cream for the kids and coffee at the local coffee joint? Gone. Jeans will have to last a few months longer, there will be fewer books paid for and less craft beer from the local beer store that just opened around the corner.

All this on top of the losses they have already incurred as a result of me investing in tax free municipal bonds. [Which, by the way, is how people like Romney get to such a low tax rate – they invest in tax free vehicles. The nerve, right?]

Any money that Obama THOUGHT he was gonna get as a tax hike has actually resulted in a net LOSS to the coffers of the Federal Government.

But hey, Obama knows better than Romney in things like tax policy and how to increase revenues.

Good job America!