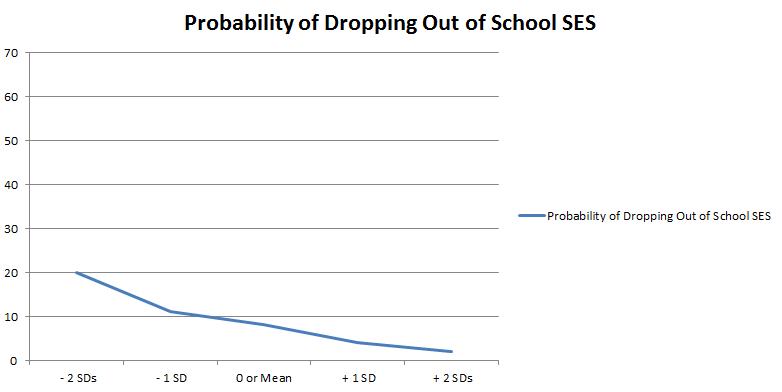

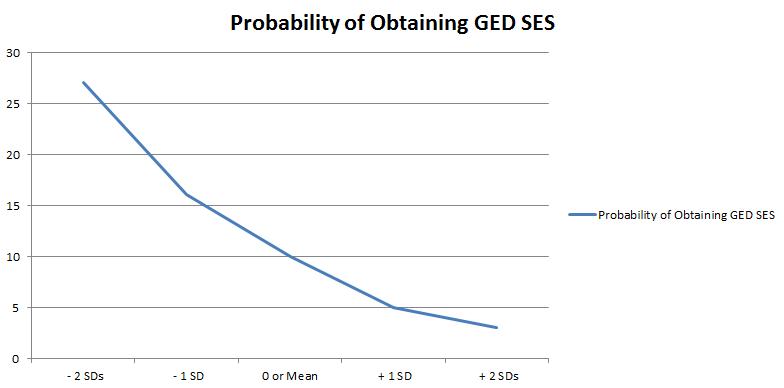

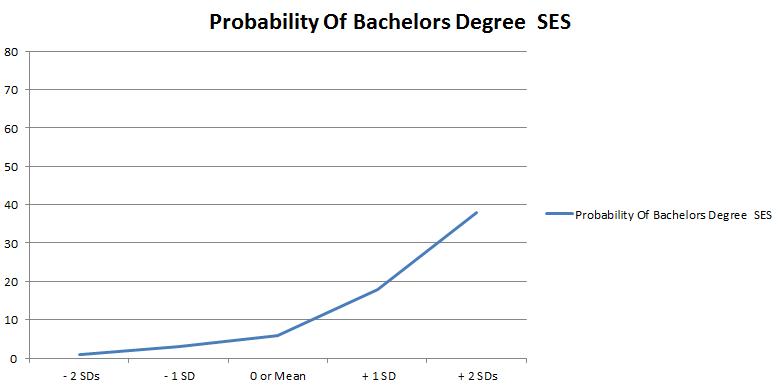

About 6 weeks ago I started posting data from the book, “The Bell Curve.” The first portion of the book deals with various conditions, poverty, education, crime and so on that take place in our society. And more than just look and detail those conditions, the authors try and look at what might cause some of those conditions. The point being that a vast majority of today’s commentators on such matters blame the socioeconomic conditions of families for the unfortunate plight many of our citizens find themselves in today.

Having problems graduating high school? Check and see if the kid is from a poor family.

Mothers raising children in poverty? Check and see of that mother herself came form a poor family.

Individuals in jail? Check and see if those folks came from a poor family.

And the evidence is there that such an impact exists. But is there another, stronger variable that impacts these conditions? The author’s answer is, “Yes. And that variable is IQ.”

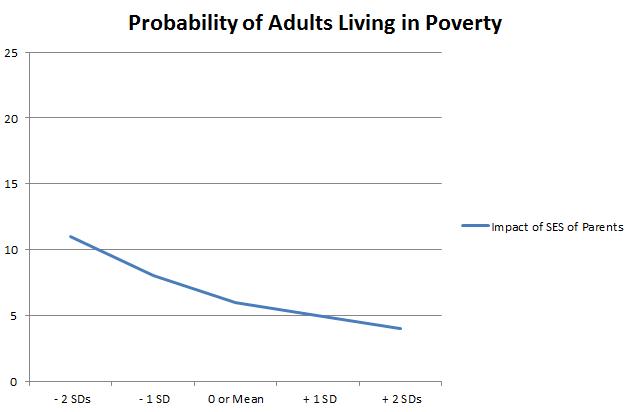

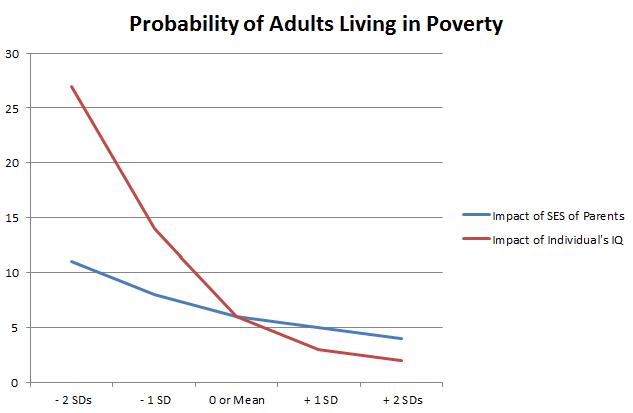

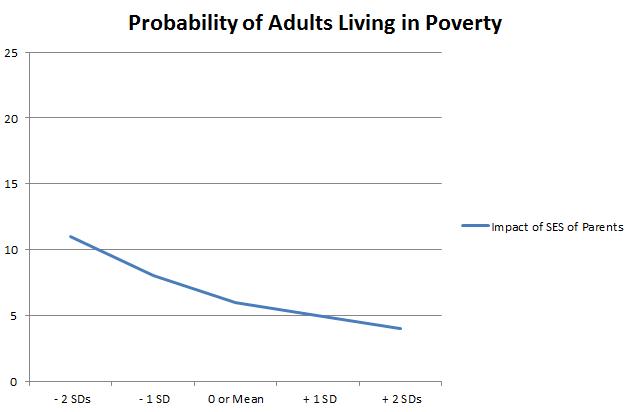

Let’s review the first set of data I showed back then. The first set of data shows the probability that an individual will be living below the poverty line in 1989, the data the study used:

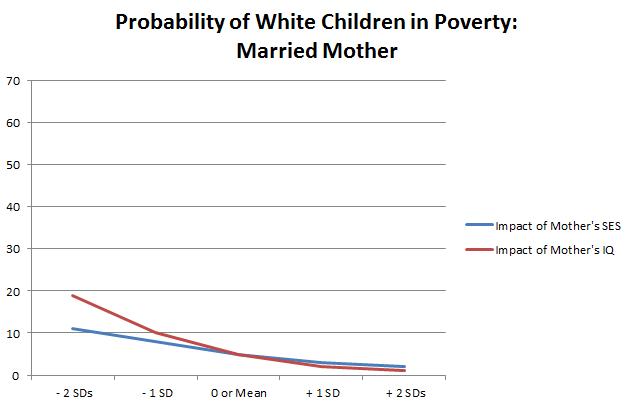

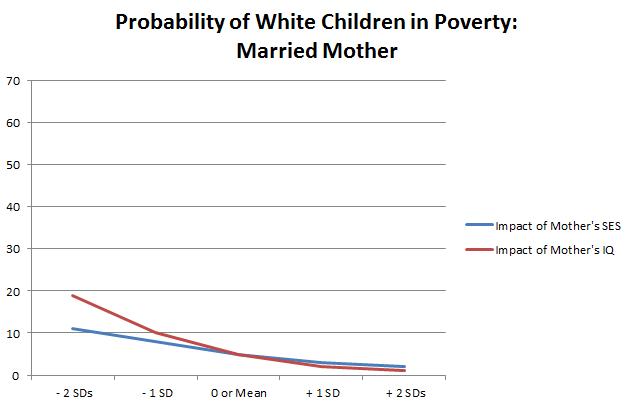

The next set of data shows the probability that a child will be living below the poverty line in 1989 when her mother is married:

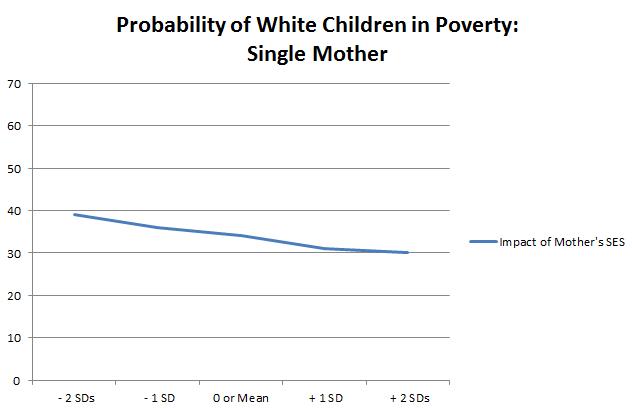

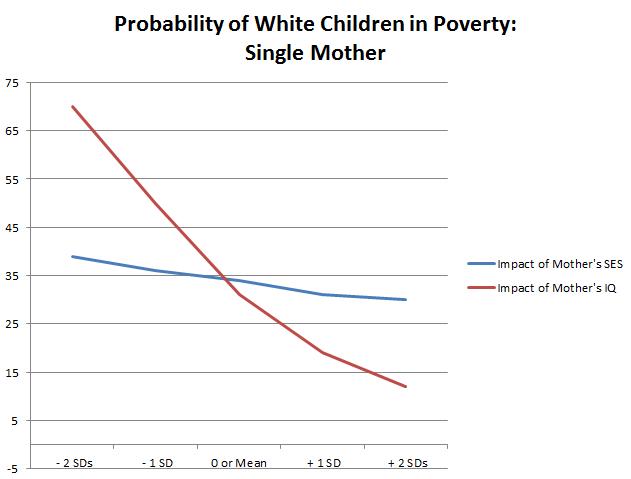

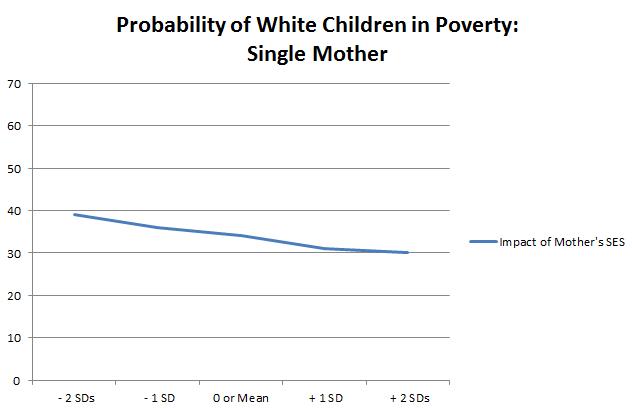

And the third set of data shows that same probability for that same child if her mother is single.

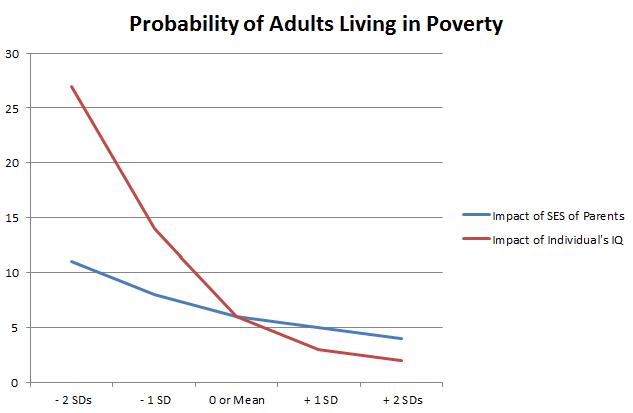

The data has an uncomfortable, but not surprising trend, to be born wealthy is better than being born in poverty. However, here the authors, as I mentioned, looked for additional variables. Specifically IQ. Look at the data with the socioeconomic status AND the IQ included in the same graph.

Let’s go down the line starting with the probability of living in poverty:

The difference is dramatic. Not only does having a very low IQ put you at significant risk of living in poverty compared to having a very low SES background, but being very intelligent is more important than being very wealthy.

Next we look at children of married mothers living in poverty and the impact that her SES and IQ have:

While the dramatic difference in the values isn’t the same, the pattern is. A mother having everything else considered who is less intelligent has a higher probability of raising her children in poverty than an equally neutral mother of higher intelligence.

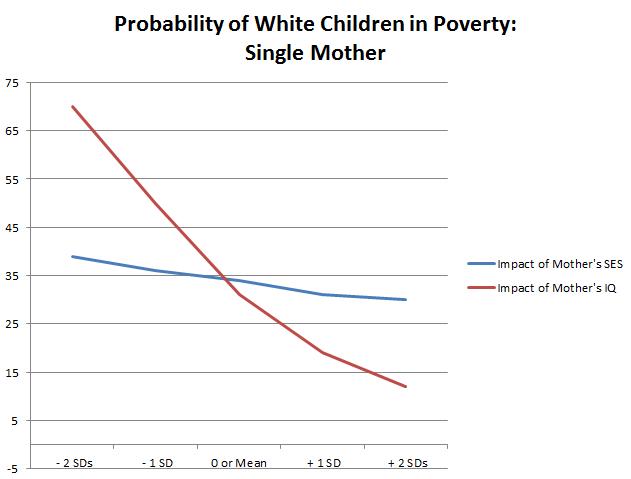

Finally, the probability of children of single mothers living in poverty and the impact that her SES and IQ have:

Right back to the dramatic difference. What looked like an impacting variable before, SES clearly now has the appearance of having a minimal effect on raising children in poverty. Rather IQ dominates this condition for children of single mothers. Those children lucky enough to be born to the brightest of mothers have a 1/7th the chance of living in poverty compared to those children whose mothers score on the very lowest on IQ tests.

Clearly, as it relates to poverty and child poverty, IQ is the runaway variable when compared to SES.