First, I admit to acknowledging the noble intention of looking to insure more Americans. I get that tug often. When new employees straight out of college walk through our doors, I try and bring up the subject of insurance and 401ks. Some listen – others don’t.

So I get it.

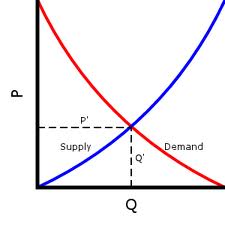

However, all the noble intentions in the world is not going to change the fact that people, in general, will tend to make decisions that maximize their best interests.

So when the government passes a law that requires employers to compensate employees in a certain manner – look for those employers to adjust their behavior. Duke did just that – they looked at employers:

Durham, N.C. — Corporate financial chiefs say they expect to reduce hiring and also move more jobs to part-time status as a result of the Affordable Care Act, according to a new survey from Duke University and CFO Magazine.

Many companies also are considering a reduction in health care benefits for employees.

This is exactly the response that we’ve been predicting since the law was passed.

It’s not surprising. Iin fact, what would be surprising is that someone was surprised:

“The results were startling to us. This will significantly impact employment,” said Campbell Harvey, a professor of finance at Duke’s Fuqua School of Business. “I think the people who drafted the bill probably never anticipated such a negative effect on employment, especially in a time when we really need employment growth.”

Okay, so Duke School of Business was surprised – but it would be hard to say that folks haven’t been warned.

How bad is it?

Almost half of the 500 companies surveyed are “reluctant” to hire full-time employees, the survey found, and one in 10 may lay off current employees in response to the law.

Some people could see their hours cut below 30 hours a week because the Affordable Care Act requires companies with 50 or more employees to provide health insurance to those working 30 hours or more a week or pay a penalty.

More than 40 percent of CFOs surveyed say their companies will consider switching some full-time jobs to part-time jobs in 2014.

“For the employee, often what that means is you have to get a second job, or you just take a hit in the amount of money you make. So, it is quite disruptive,” Harvey said.

The single best method to reduce costs, increase quality and expand availability is to expose the product to an ever free’er -yet maintaining contract laws- market. Profit motive and self interests will prevail and the more expensive objects today will become commoditized tomorrow.

So really, the question shouldn’t be, “Do we want to provide health care to everyone?” The question should be, “What costs are we going to expose our nation to in order to provide this coverage?”

Would you trade 43 hours a week for a 37 hour week for our nation? Would you trade a single point of unemployment; go from 6.5 to 6.6 perhaps?

How many unemployed people would you be willing to accept in order to realize the gain of insurance for all?

Those are the questions that need to be answered.