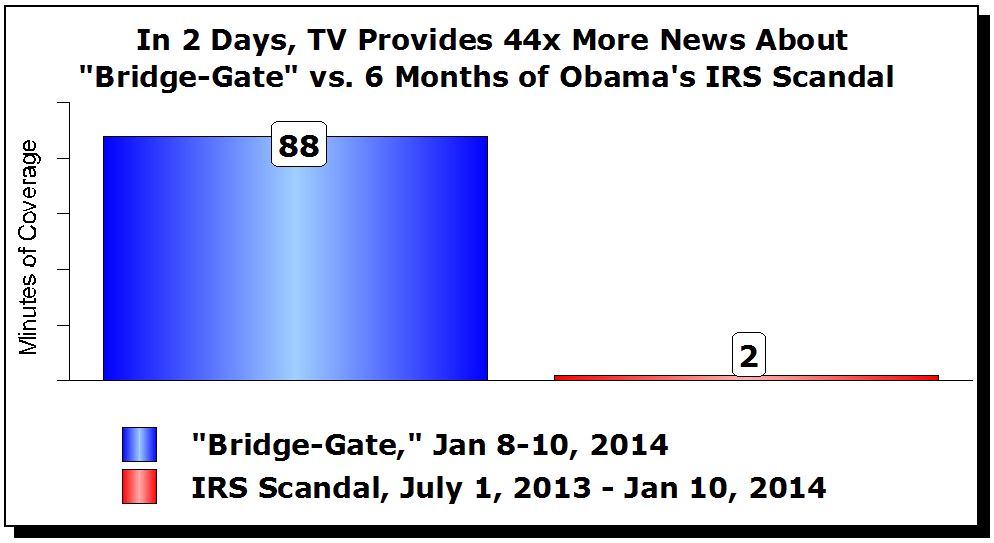

Recently ReflectionEphemeral posted on the IRS scandal:

On a scale of 1-10, the IRS scandal seems to me about a 3. It is improper to focus on one side’s fundraising groups. An overall examination of supposedly tax-exempt organizations would probably be worthwhile. But they didn’t audit or persecute people; they sent them additional questionnaires.

Recently, nickgb got me thinking that perhaps profiling groups isn’t that bad an idea. In fact, it’s an idea that I have been a proponent of in the gun debate. As such, RR may have a point. Overtly political groups may need to be audited. However, it might be nice if such political groups were audited in equal measure based on their ideology; right and left groups.

However, in RR’s post, he pointed out the fact that there maybe a bigger scandal:

If someone at the IRS actually took confidential information and sent it out, that’s unequivocally a crime.

Well, as it turns out:

ProPublica on Monday reported that the same IRS division that targeted conservative groups for special scrutiny during the 2012 election cycle provided the investigative-reporting organization with confidential applications for tax-exempt status.

That revelation contradicts previous statements from the agency and may represent a violation of federal guidelines. Lois G. Lerner, who heads the IRS sector that reviews tax-exemption applications, told a congressional oversight committee in April 2012 that IRS code prohibited the agency from providing information about groups that had not yet been approved.

As an interesting experiment I Googled “ProPublica IRS”:

Not one single major news source on the first page. And when I include “CBSnews” in the search I do get a New York CBS affiliate and, at the bottom, a cbsnews.com story about how the scandals benefits conservatives. And even that story is lifted from Slate.

Anyway, it would seem that we now have a legit scandal. We’ll see if it goes anywhere.