Anyone who pays attention, and even a few of us who don’t, know that we are facing what the experts are calling “The Fiscal Cliff.” This is in reference to the set of economic or fiscal policies set to be enacted if nothing changes. That is, it is already law and will be implemented unless new laws are passed to change them. Key among this cliff are two main components:

- Allowing the Bush Tax Cuts to expire.

- Sequestration – Mandatory budget cuts.

Recent headlines have cited a CBO report issued earlier this month. In it, the CBO reports that tax hikes on the wealthy won’t really hurt the economy:

(Reuters) – Allowing income tax rates to rise for wealthy Americans, and maintaining rates for the less affluent, would not hurt U.S. economic growth much in 2013, the Congressional Budget Office said on Thursday, stepping into a dispute between Republicans and Democrats over how to resolve the so-called “fiscal cliff.”

The report by the authoritative non-partisan arm of Congress is expected to fuel President Barack Obama’s demand for higher taxes on the rich, part of his proposal to avoid the full impact of the expiring tax cuts and across-the-board spending reductions set to begin in early 2013 unless Congress acts.

The narrative is that allowing Obama to follow through on the class warfare rhetoric wouldn’t really be that harmful to the economy; almost saying that any negative impact is worth it in order to restore “fairness.”

This report, and other just like it, are using the individual analysis of each portion of the fiscal cliff:

Extending all expiring tax provisions other than the cut in the payroll tax and indexing the AMT for inflation— except for allowing the expiration of lower tax rates on income above $250,000 for couples and $200,000 for single taxpayers—would boost real GDP by about 1¼ percent by the end of 2013. That effect is nearly as large as the effect of making all of those changes in law and extending the lower tax rates on higher incomes as well (which CBO estimates to be a little less than 1½ percent, as noted above), primarily because the budgetary impact would be nearly as large (and secondarily because the extension of lower tax rates on higher incomes would have a relatively small effect on output per dollar of budgetary cost).

So, by keeping the tax cuts for everyone under 250k we grow by 1.25%. But if we keep ALL tax cuts we grow by 1.5%. And the analysis is that the 1/4 point in GDP isn’t significant. Perhaps. But it represents 16.67% more growth than if we raise the taxes on the wealthy.

16.67 percent seems like a pretty big “get,” especially when the President is struggling as is.

But how about jobs:

The CBO said the tax hikes for the wealthy would reduce job growth by around 200,000 jobs…

For a President that is interested in growing jobs, he has a funny way of showing it.

So, what happens if we avoid the cliff?

Output would be greater and unemployment lower in the

next few years if some or all of the fiscal tightening scheduled

under current law—sometimes called the fiscal

cliff—was removed.

Nice.

But is that all?

However, CBO expects that even if

all of the fiscal tightening was eliminated, the economy would remain below its potential and the unemployment rate would remain higher than usual for some time. Moreover, if the fiscal tightening was removed and the policies that are currently in effect were kept in place indefinitely, a continued surge in federal debt during the rest of this decade and beyond would raise the risk of a fiscal crisis (in which the government would lose the ability to borrow money at affordable interest rates) …

Yeah….that’s interesting, but what happens if we do nothing and just fall over the cliff?

…Moreover, if the fiscal tightening was removed and the policies that are currently in effect were kept in place indefinitely, a continued surge in federal debt during the rest of this decade and beyond would raise the risk of a fiscal crisis (in which the government would lose the ability to borrow money at affordable interest rates) and would eventually reduce the nation’s output and income below what would occur if the fiscal tightening was

allowed to take place as currently set by law.

Not for nothing, but I think that reading ALL THE WAY to the second paragraph and reporting on the part of the report that kinda isn’t friendly to Obama is somewhat important.

Be that as it is, if it were me and I was the Speaker, I’d tell the Barackness Monster to go to hell, hold on and jump. We’d be better off.

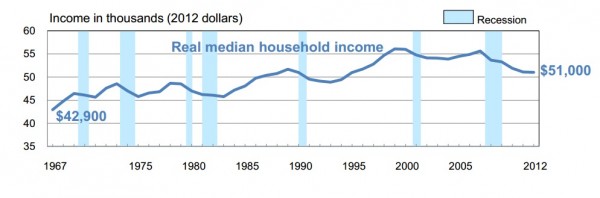

Leading up to the recession, real median income was rising. It’s only been since Obama’s time in the White House that such incomes are dropping.

Leading up to the recession, real median income was rising. It’s only been since Obama’s time in the White House that such incomes are dropping.