Money. The spending of it. The making of it. Revenue and expenditure.

How to manage it all responsibly?

Recently, always[?], there has been a debate regarding the deficit and the debt. How we as a nation spend vs how much we as a nation bring in. The most recent event was the fiscal cliff. The new event is the debt ceiling negotiations. And yes, there will be negotiations regardless of what the President says or what he wants.

Leave aside the partisan bickering for a second and let’s just look at this in a way that people kinda get; real world.

Typically, a household has an idea on how much money they bring in. And this amount of money dictates how much they spend, typically. In college I brought in very little – I spent very little. Out of college I brought in more and spent more. And during these times, my spending would, indeed, fluctuate. I could count on certain bills and expenditures but others would just come up. A broken muffler, a wedding out of state. Maybe dental work.

My budget would often shift. But it was always thought of in relation to how much I could bring in. I knew that I was taking a short term hit but long term gain by going to college. Earnings would suffer but the long term outlook was positive.

But my debt was always defined in relation to MY reality.

Earlier this week, the fellas at Poison Your Mind posted on the fact that the United States is a low tax country:

Of course, one can have a political preference that the US maintain extremely low taxes and/or reduce the size of government, but neither political inclination is compelled by The Math.

I assume, with all the risks commensurate, that by referencing “The Math” RR is referring to the fact that republicans claim spending is to blame for our deficit, not taxes. In fact, the chart accompanying the post shows that the United States is near the bottom in tax revenue indicating that tax revenue, and not necessarily spending, is the problem.

But to me, that doesn’t jive.

Back to younger me. I existed in my own reality. I went to school, church and lodge with members of my community that existed on a range of socioeconomic status. Virtually ALL earned more than I did. And now, flash forward to today, I exist in that same strata, many peers earn more, many less. None of which have any bearing on defining the health of my financial status.

I must balance my spending with my revenue.

In some cases I earn less due to sheer ability. They have it and I don’t. In other cases it’s based on desire; they have it and I don’t. In others, I earn more because I am the one with the desire or the ability. And yet in others, people have decided that compensation takes forms other than money; time off, value to society and personal growth are examples. Whatever the individual situation is, basing fiscal health on the experience of others is rather short sighted. And in the end, not at all healthy.

For whatever reason, perhaps because we are an independent colony all grown up. Maybe it’s because we have access to massive natural resources. Or education, or – well, whatever. Whatever the reason, America has decided that it only wants to generate “X” amount of revenue. We don’t wanna work harder to earn more per hour, or take an second job. We’re cool where we are.

Given that reality, our spending has to reflect that fiscal reality and adjust. It just has to. And if it doesn’t, then spending is the problem.

But back to the chart, it IS rather stark. After all, we are the United States of America and certainly have reason to expect that we come in better than 4th from the bottom. Am I missing something?

Well maybe.

See, we may only be taxing at a very low rate of GDP, but we are a very VERY rich nation. So, while a person may argue that a policy of higher tax revenue is desirable, the larger question may be ignored. Namely, is the nation wealthier as a result of such taxation or less wealthy as a result.

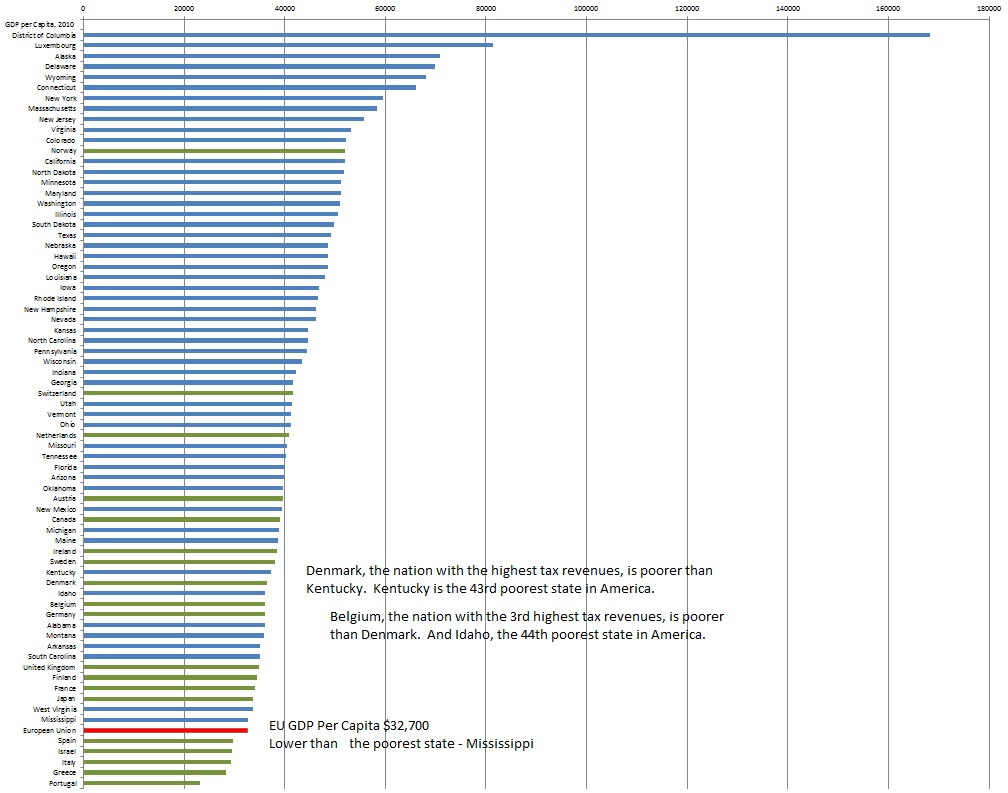

There is data:

It turns out that America does well compared to her high tax peers. For example, Denmark, the nation with the highest revenues, is very poor compared ti the states of the United States. In fact, if Denmark WERE a states, it would rank only as the 44th richest state in the Union. Behind Kentucky. And Belgium, the nation with the 3rd highest tax revenues? Why, it would rank below even Denmark, poorer even than Idaho.

The EU as a whole, with Spain, Israel, Italy, Greece and Portugal all, ALL, rank lower than the poorest state in our nation; Mississippi.

This might mean that such high tax rates lead to less prosperous nations. Or it might mean that such high tax rates are really an illusion of mathematics – revenues compared to a paltry GDP may seem higher than they really are. Whatever the explanation, I doubt anyone would argue that we would wanna live in a nation that would rank among the poorest of our states.

“America has decided that it only wants to generate ‘X’ amount of revenue.” I don’t know that America has decided that, I think that’s kind of what we’re all arguing about, isn’t it?

I don’t know that America has decided that, I think that’s kind of what we’re all arguing about, isn’t it?

Well, historically, we have kept a remarkable revenue stream of about 18% GDP. Certainly during economic slowdowns, this number falls, but generally it’s true.

Given that American’s are unwilling to “work overtime”, “get a second part time job” or “look for a better paying job” we’re in a place where spending is 18%.

Therefore, given the predictable revenue, our deficit is a result of over spending.

No one would counsel a young couple living in a neighborhood made up of $1 million homes drawing a salary of $35,000 that they have a revenue problem only because their peers are pulling $300,000. Instead, the advice would be to more to a neighborhood you can afford in order to address your spending.

I’m not sure the analogy to a household is the best out there. Probably better to compare to a corporation, many of whom carry debt (short and longterm) in order to function

I’m not sure the analogy to a household is the best out there.

You’re probably right. But it’s it’s useful to explain things to people who only have experience in household budgets.

Probably better to compare to a corporation, many of whom carry debt (short and longterm) in order to function

True. But many households carry short-medium-long term debt.

The chart on the PoisonYourMind site shows the U.S. tax rate at 27.3% of GDP. I do not call that low. That seems terribly high to me. Are we supposed to feel guilty because other countries spend even more?

I am also not clear if this 27.3% figure includes all taxes or just Federal income taxes. Perhaps I read the linked story incorrectly, but it appears that state sales tax, local property taxes, fuel road taxes, etc are not included in that 27.3%.

The chart on the PoisonYourMind site shows the U.S. tax rate at 27.3% of GDP. I do not call that low. That seems terribly high to me.

And this gets to my point.

The taxation levels in America are where they are because that’s where we want them to be.

Are we supposed to feel guilty because other countries spend even more?

I think that’s the gist.

Pino ,

We are a nation of pension seekers. We all want to kick back and get a check . Most especially if we are working in a job that is less than ideal . I rationalize my own desires by the fact that I have worked three and a half decades and paid into Mr. Ponzi’s lock box . We can’t all be on pension, but even those who have not paid the dues believe they are owed . They do not know or care that we owe $ 16 Trillion . Obama’s class war allows them to rationalize their own moral sliminess . I know this because I speak to them all the time .

We are a nation of pension seekers.

This is not unique to America; it is human nature.

They do not know or care that we owe $ 16 Trillion . Obama’s class war allows them to rationalize their own moral sliminess .

Well…it certainly creates perverse incentives.

I think that if we’re cutting spending that hurts the poor and middle class, then we have to raise taxes on those who have made off so well in recent years. High GDPs aren’t necessarily good if it is due to the wealthiest making the most and the distribution of income is poor. That’s what’s been happening here, and that could threaten social stability.

I think that if we’re cutting spending that hurts the poor and middle class

I don’t think that returning to previous levels of spending is really “cutting”.

I don’t think that returning to previous levels of spending is really “cutting”.

I should rephrase that:

I don’t think that returning to pre-stimulus levels of spending…….

Western Europe is full of pensions , earned and unearned . Southern Europe is collapsing first, but the Northern States like Sweden, and Germany will not survive forever either . Low GDPs are a symptom of Socialism . Low GDPs cause low economic mobility which has always been the hallmark of Europe’s class societies . America was different in the past . People always moved up the ladder . Those at the very top did not stay there forever. Now thanks to our great move to the left, more are seeing the rungs above them missing , while the rungs below are being greased . Borrowing 40 cents of every dollar you spend will do that .

The proof is in the numbers . So far threats of tax increases and tax increases themselves on the rich have failed to help the poor and middle class . In this case numbers do not lie .