There has been a constant dull roar regarding the meme of income inequality. I often see it in blogs and news articles in left leaning publications. Lately though, I’ve seen it hit my social media pages. Last night I found the whole thing summed up in one article:

Now we are engaged in a great tug-of-war over a few points in the top tax rate in Washington. But even if the White House pulls hardest, it won’t amount to much of a victory for the long-suffering middle class. The sources of their income stagnation are too deep, too varied, and too long-term for Clinton-era tax rates to cure them.

“There is a huge amount of focus on progressive taxes in our policy world but progressive taxes are not much of a solution to this,” said Lawrence Mishel, president of the left-leaning Economic Policy Institute. “We need to get unemployment down rapidly. We need to greatly change our labor standards. We need to raise the minimum wage.”

He’s right: The middle class crisis — and its resulting income inequality — is the most important economic story of our time. There are a million ways to tell it, and here’s another: an annotated slide show, culled from the amazing 2012 edition of the State of Working America from EPI.

Thompson goes into an argument for the next 16-17 slides and discusses the usual suspects; wage gap, wealth distribution, distribution of stock market wealth and minimum wage. There are some other pieces of data there to, but all the big ones were represented.

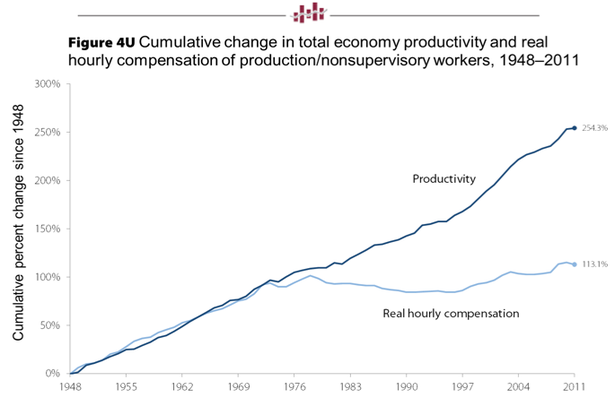

As I scrolled through, I just by chance grabbed the 2nd chart to investigate. Thompson says:

Adding to the mystery is the remarkable de-coupling of productivity from real hourly compensation for all workers, including college graduates. The break seems to have occurred in the 1970s and accelerated very recently. Productivity grew steadily in the 2000s. Compensation didn’t.

I checked into what might have happened that would cause this de-coupling. This is what I found:

The level of productivity doubled in the U.S. nonfarm business sector between 1970 and 2006. Wages, or more accurately total compensation per hour, increased at approximately the same annual rate during that period if nominal compensation is adjusted for inflation in the same way as the nominal output measure that is used to calculate productivity.

More specifically, the doubling of productivity since 1970 represented a 1.9 percent annual rate of increase. Real compensation per hour rose at 1.7 percent per year when nominal compensation is deflated using the same nonfarm business sector output price index.

In the more recent period between 2000 and 2007, productivity rose much more rapidly (2.9 percent a year) and compensation per hour rose nearly as fast (2.5 percent a year).

The relation between productivity and wages has been a source of substantial controversy, not only because of its inherent importance but also because of the conceptual measurement issues that arise in making the comparison.

…

Two principal measurement mistakes have led some analysts to conclude that the rise in labor income has not kept up with the growth in productivity. The first of these is a focus on wages rather than total compensation. Because of the rise in fringe benefits and other noncash payments, wages have not risen as rapidly as total compensation. It is important therefore to compare the productivity rise with the increase of total compensation rather than with the increase of the narrower measure of just wages and salaries.

The second measurement problem is the way in which nominal output and nominal compensation are converted to real values before making the comparison. Although any consistent deflation of the two series of nominal values will show similar movements of productivity and compensation, it is misleading in this context to use two different deflators, one for measuring productivity and the other for measuring real compensation.

In short, compensation has, in fact, kept pace with productivity not lagged. In fact:

Total employee compensation as a share of national income was 66 percent of national income in 1970 and 64 percent in 2006. This measure of the labor compensation share has been remarkably stable since the 1970s. It rose from an average of 62 percent in the decade of the 1960s to 66 percent in the decades of the 1970s and 1980s and then declined to 65 percent in the decade of the 1990s where it has again been from 2000 until the most recent quarter.

Again, when viewed as compensation and not the more simplistic wage, we are, to quote, remarkably stable” since the 1970’s.

But what happened in 1970’s that might change the way compensation was distributed? Legislation:

During the 1970s, there were some important legislative and legal changes affecting compensation and workplace issues. Among the most important were the Employee Retirement Income Security Act of 1974 (ERISA) and the Revenue Act of 1978. ERISA regulated private pensions and imposed financial and accounting controls. ERISA also established the Pension Benefit Guaranty Corporation to ensure that workers would be paid their vested pension benefits, if their pension plans were terminated. The Revenue Act encouraged flexible benefit plans, and created the 401(k) defined contribution retirement savings plan. It also allowed employees to make elective pre-tax contributions to a variety of savings vehicles, such as saving, profit sharing, and employee stock ownership plans. In retrospect, these laws were extremely important, as they contributed to the change in the share of compensation accounted for by pensions and other retirement benefits.

Other important legislation that affected active and retired workers without necessarily affecting compensation directly included the Occupational Safety and Health Act of 1970, which authorized the Secretary of Labor to establish occupational safety and health standards in the workplace; the Comprehensive Employment Training Act of 1973, which consolidated and decentralized Federal employment programs and provided funds to State and local governments who sponsored employment services; and the 1974 amendment to the Social Security Act, which provides automatic cost-of-living adjustments, based on the Bureau’s Consumer Price Index.

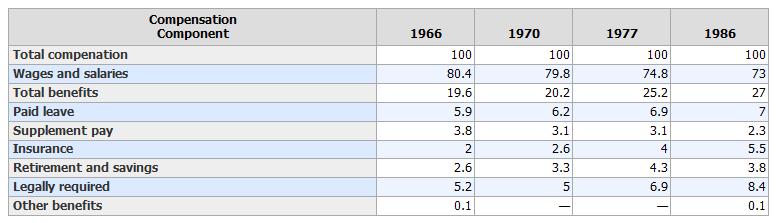

The below chart shows what has happened over the twenty year period from 1966 to 1986:

Just in those 20 years, cash money took a nearly 10% hit in the ratio of compensation. Keeping that compensation constant, there should be little surprise that wages have fallen in proportion to productivity.

It turns out that Thompson’s analysis of the data depicted in that chart is incorrect, or misleading. Employees are being compensated nearly the same since at least 1970.