I was thinking about energy subsidies this weekend. I know I know, geeky shit to be sure, however – I WAS stuck watching a dance conference with my daughter in Baltimore, so slack please!

Anyway, during the election season, Obama was attacked for his green energy subsidies. That, in his attempt to pick winners and losers, he mostly picked losers. All of which, of course, was to highlight the waste of money that is green energy subsidies.

It occurred to me, that depending on the type of subsidy, it’s okay that we encourage alternative energy research and advancement.

To be sure, I don’t like the government actually spending money or guaranteeing loans, to one company or technology over another. However, when it comes to reducing the tax burden so that we advance investment, I don’t see any reason why we should pick oil and gas over solar and wind.

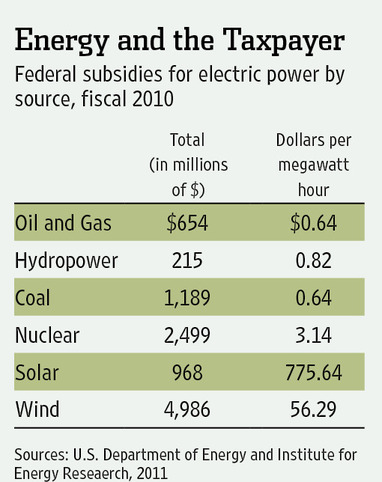

With that said, this is an interesting graph:

The folks at the Institute for Energy Research used the Energy Department data to calculate a subsidy per unit of electricity produced. Per megawatt hour, natural gas, oil and coal received 64 cents, hydropower 82 cents, nuclear $3.14, wind $56.29 and solar a whopping $775.64.

So for every tax dollar that goes to coal, oil and natural gas, wind gets $88 and solar $1,212. After all the hype and dollars, in 2010 wind and solar combined for 2.3% of electric generation—2.3% for wind and 0% and a rounding error for solar. Renewables contributed 10.3% overall, though 6.2% is hydro. Some “investment.”

Zooming out for all energy, the Congressional Research Service did its own analysis of tax incentives last year. It found that in 2009 fossil fuels accounted for 78% of U.S. energy production but received only 12.6% of tax incentives. Renewables accounted for 11% of energy production but received 77% of the tax subsidies—and that understates the figure because it leaves out direct spending.

Which brings me to my initial thought:

By the way, these subsidy comparisons don’t consider that the coal, oil, and natural gas industries paid more than $10 billion of taxes in 2009. Wind and solar are net drains on the Treasury.

All of this suggests a radical idea. Why not eliminate all federal energy subsidies? This would get the government out of the business of picking winners and losers—mostly losers.

Mr. Obama’s plan to eliminate oil and gas subsidies would lower the budget deficit by less than $3 billion a year, but creating a true level playing field in energy, and allowing markets to determine which energy sources are used, would save $37 billion. That’s an energy plan that makes sense.

I like that idea best. Less government.