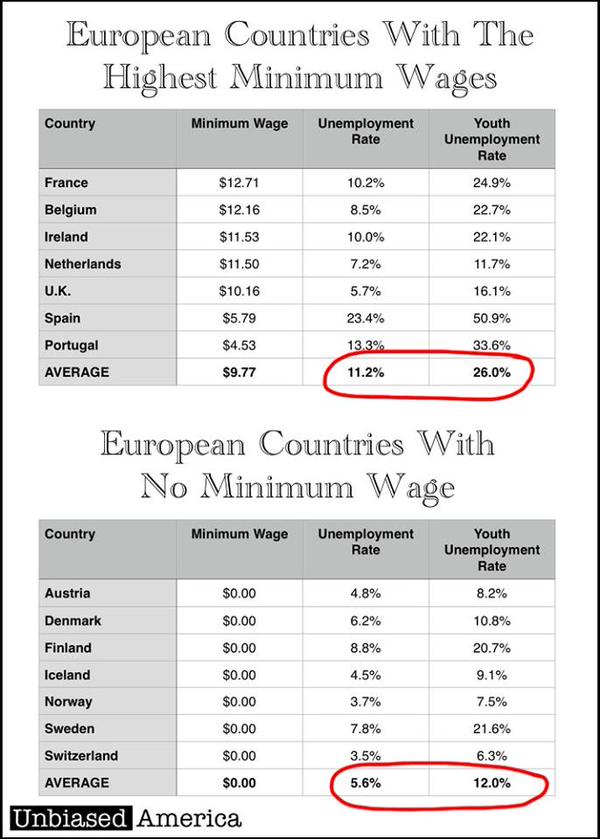

I’ve been meaning to write a larger post with the data above that I found at Carpe Diem, but I just haven’t gotten around to it. Instead I’ll pass it along with some comments.

- I am VERY surprised that the Nordic countries have no minimum wage.

- I would never have guessed the youth unemployment rates would be so high in Finland and Sweden – darlings of the big-nanny state fan boys.

- The average youth unemployment for the nations with a minimum wage is higher than the highest value for those nations without such a wage.

1) Scandinavian countries don’t have minimum wages, ironically, because they are so strongly unionized: http://www.forbes.com/2009/08/31/europe-minimum-wage-lifestyle-wages.html

2) If a minimum wage really caused these problems, then you’d see some sort of correlation showing that unemployment generally decreased as the minimum wage got lower, but you don’t. Instead you see virtually random numbers.

3) The takeaway from this is that you have it all backwards. Those countries aren’t experienced low unemployment because of their zero minimum wage, rather they don’t need to have a minimum wage because of strong safety nets and strong protections for workers.

While we’re at it, I went ahead and plotted the minimum wage and unemployment numbers for European countries: http://imgur.com/fOYyy6D

I also ran a correlation analysis and got a result of -0.04078, which basically means no correlation at all. I ran it again using unemployment rates against student/teacher ratios in primary school, and found the correlation to be -0.1152. That’s 3 times higher, and still falls into the “negligible correlation” range.

I’d also like to note that their chart of “highest minimum wages” doesn’t include Luxembourg or Germany, which have higher MW than Spain and Portugal according to wikipedia (but lower unemployment rates). Portugal’s minimum wage is even lower than Slovenia and Malta, which also have lower unemployment rates. The chart seems to be very selective in its data points, as opposed to my chart which covered the whole data set.

nickgb | July 28, 2015 at 12:31 pm

Good to see you old friend.

The chart seems to be very selective in its data points, as opposed to my chart which covered the whole data set.

Great analysis!

I did some more reading on the Carpe Diem site and found this post:

http://www.aei.org/publication/in-western-europe-the-average-jobless-rate-is-twice-as-high-in-countries-with-a-minimum-wage-vs-those-with-no-minimum/

Here he seems to be reserving his analysis of Western Europe due to the piece here:

http://www.themoneyillusion.com/?p=24759

Why the author made the decision to include only Western Europe is lost on me.

That may be one of the dumbest things I’ve ever read… (The Money Illusion, that is).

His first comparison is based purely on the highest marginal tax rate, which affects only some Americans and only affects their highest amounts of income. For example, here are some tax regimes:

1) You pay 20% of your income

2) You pay 15% of your income up to a million dollars, then 21%

3) You pay 0% of your income up to a quadrillion dollars, then 22% of every dollar above that.

His analysis would say that #3 is the highest tax rate, despite having the lowest overall burden on every human in existence. He would rank #2 the second highest, even though it would be better for the vast majority of Americans. Etc., etc.

There’s an obsession on the right with marginal tax rates, and it’s really silly. If I pay 20% up to a billion dollars, then 25% after a billion dollars, I’m not going to stop at a billion and say “It’s not worth it any more.” These aren’t pool cleaners and small town CPAs, they’re empire-owners and they wouldn’t stop earning unless the MTR was 100% (and even then might because they’d be increasing gross revenue but getting a loss for tax purposes!). Nonetheless, I still hear people talking about not wanting to make more money because it’ll put them in a higher tax bracket, and that fundamentally misses how the system works. It’s not a partisan difference, it’s an actual misunderstanding of the tax system.

None of this is about your point, of course, I just hadn’t read that link until now and I want to set that person’s house on fire. MTR is simply irrelevant for pretty much anything. It’s a wealth tax, in essence, and is almost never set to a level that affects more than a handful of people in the country.

Good to be back, albeit for a one-night-show. PYM is dead and gone, and as fun as it would be to sit back and laugh at this cycle’s clown car, I just don’t have the energy or the vitriol anymore.

That may be one of the dumbest things I’ve ever read… (The Money Illusion, that is).

Yeah, I’m just pointing out the reason for Western European nations.

If I pay 20% up to a billion dollars, then 25% after a billion dollars, I’m not going to stop at a billion and say “It’s not worth it any more.”

After Obama won in 2012 our financial adviser sat my wife and I down and we discussed options – including retiring, certainly not working harder to get promoted or even flat out giving money away to avoid paying taxes.

1) But that doesn’t explain anything about the countries he picked. That article actually does mention Germany and Luxembourg, which he omits in his post because it would skew his numbers away from the point he wants to make. If anything, that other link makes it even clearer than this was BS “analysis”.

2) So your counterargument is that you panicked and talked to a financial adviser about things that would only make your financial situation worse after someone got elected but before they proposed any specific tax changes?

My point is this: Our tax code is structured so that there’s no disincentive for making more money. Now, there are diminishing returns for sure, the millionth dollar you make is worth less than the first, or the thousandth, etc., but it’s never worth less than zero. You might be able to cobble together a one-off where a person somehow owes more because they make more money, but I haven’t been able to do it myself.

The bottom line is that marginal tax rates never cost you money for making more money. People think that going into a higher tax bracket suddenly means you are paying that higher rate on your whole income, and that simply isn’t true. Going from $X income to $X+1,000 never leaves you with less than you had before.

More to the point, no one would EVER make such a system! You want a tax code that is designed to maximize revenue. A tax system that punishes you for making more is a tax system that will lead to less tax revenue. If the government wants your money so badly, why would they do that? This is one of those scare tactics that they trot out because no one understands the tax system, but it never holds up.

1. Yeah – I don’t know why he picked the countries he did.

2. Well – We’ve had this adviser since 2006. And we didn’t retire, stop over achieving at the office or gave our money away. But the point is this; “Why bust my ass for the next dollar when government takes better than 40%?

At some point I just say, “fuck it – I’m not gonna produce at that higher level.” Which is tragic – because if the system is working, those people are our highest producers.