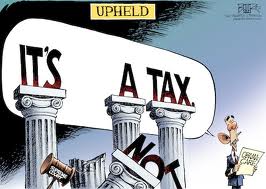

Let’s set aside the debate on whether or not the mandate represents a penalty or a tax. In many ways, it doesn’t matter; the bill was made law, the law was challenged and the law remains the law.

A question occurred to me as I was watering failing to save my flowers Saturday:

Given that individuals are offered the choice of purchasing health insurance or paying a penalty, and that penalty is paid to the federal government of the United States, what will this do to health insurance premiums?

The answer is, of course, “Insurance premiums will go up.”

Individuals will make a value based decision on whether or not to purchase insurance or pay the penalty/tax. The problem comes into play when you consider that the organization making the determination, and receiving the money, of how much that penalty/tax will be is NOT the same organization that is required to insure people who decide not to purchase insurance.

In short, the insurance company has to cover uninsured individuals while the government keeps the penalty/tax. What this means to the insurance companies is that they have to cover uninsured people for free. And since coverage of medical costs isn’t really free, they will have to raise the rates of everyone to cover those costs. As those costs rise, more and more Americans will conduct value propositions and conclude that purchasing insurance isn’t worth it.

And costs will rise.

And costs will rise.

And costs will rise.