I suspect that even pedestrian news watchers have heard of the fiscal cliff by now. I hold out very little hope, however, that even a basic understanding of what that means is had. Which, I suppose, is par for the course.

However, here on the hallowed pages of TarHeel Red, it means that the federal government has some decisions to make. We could, for example, go off the cliff. Some think that not such a bad idea. Me, for example. I think that taking the hard steps required to cut spending, even defense spending, are long past due. Sadly, I’m joined in this analysis by Hoard Dean. I’m suspicious of the twist of fate that cause him to agree with me; I’m afraid to discover which of us has made the mistake in calculus.

However, there are other courses to take. We could make permanent the Bush era tax cuts. For everybody. For some. We could take this opportunity to cut spending even more, maybe even in a REAL way that real Americans understand. For example, the local specialty beer shop around the corner sells individual bottles of goodness for $2 American. I like to stop in and buy a six-pack every other week. My spend is $24 a month.

But let’s say that I budget an increase, I want to not only buy those 2 six-packs a month, but I wanna add the full liter of specialty beer. I up my spend from 24 bucks to $31. But then….then, well, Obama wins the election and my financial adviser says that I should cut back, so I say, “Okay.” And instead of buying 12 beers a month I buy 14; an extra $4.

My man goes crazy, he’s out of his head crazy. He demands to know how I agreed to cut the amount of money I spend on beer and THEN expanded it. I tell him simple, “I had budgeted a $31 expenditure. I reduced it to $28. I cut out nearly 10%!”

Serious. Politicians, all of ’em, dem and repub, look us in the eye and say this with a straight face.

Anyway. The cliff.

Obama wants to raise the rate of taxation on the rich. And when he says that, he means the rate of federal income tax. He frames the question in terms of the federal income tax rate. So, I usually speak about the federal income tax rate. And this is what I say:

According to the CBO, in aggregate, the poorest 60% of us don’t pay a federal income tax. Worse, the top quintile, the wealthiest 20%, pay more than 94% of federal incomes taxes according to the most recent numbers in 2009.

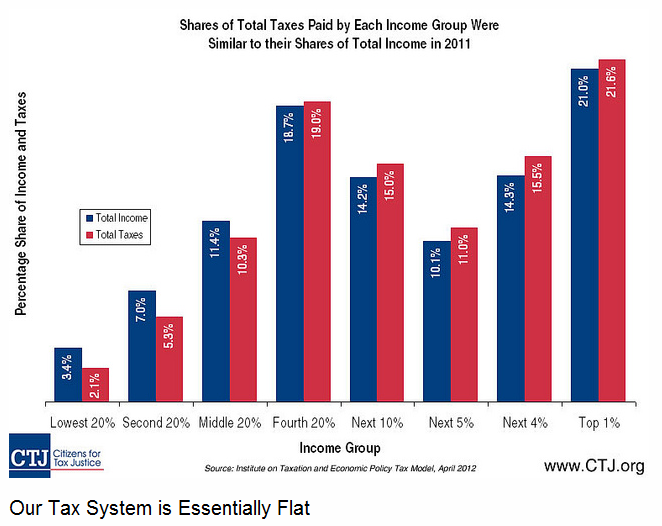

When Obama claims that the rich don’t pay their fair share, he’s not making sense. The rich are paying dramatically more than their fair share. However, I have folks that disagree with me. And those that do point to this graph:

This graph, built by Citizens for Tax Justice, shows that as a % of income, we all typically pay about the same share of taxes. For a time I couldn’t square the data. The report from the CBO didn’t seem to jive with the data coming from CTJ.

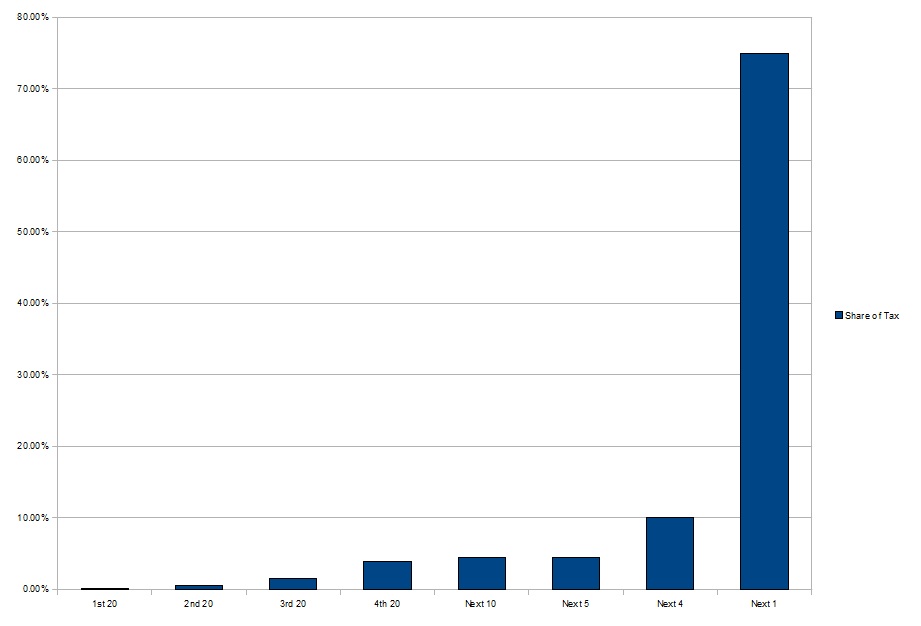

Then I realized my mistake. We’re talking about two different units. The CBO data that I was using was reporting share of tax revenue. The CTJ is using share of income. When I used the “back of an envelope” – I had too, the CTJ data is in 2011 numbers and the CBO data is in 2009. Further, I used the average of the quintiles and not the total population so my numbers may be off. However, if the details can be run, I’d be interested in seeing that. This is what I came up with:

Now we’re talking apples and apples. I broke out the quintiles in that weird way that folks do; listing the first 4 and then breaking down the last by the “nest 10”, “the next 5”, “the next 4” and “the top 1.” What this means is that if you gather than top quintile in one group you would see that they pay 93.93% of all taxes. And this is on an earning of 50.0% of all income.

Holy moly.

The top 20% of Americans earn 50% of the income and yet pay 94% of the taxes.

Well, “fair share” is a matter of opinion. When one person works 50 hours a week, has no vacation, and can barely pay his family’s expenses while another works 40 hours and makes loads of investment income, the latter certainly can pay more with less pain than the former. And, of course, people with different core beliefs about that will define (and graph) their arguments differently. I look at your graph and think, ‘wow, look how skewed income is in the US, our system clearly has a structural advantage for the already wealthy.” To me that makes it imperative that the tax increase fall on the wealthiest. You read it differently.

So, in the end, I think we have to (as do the politicians) compromise. I actually agree that significant cuts are necessary. I do have a quandry – cutting spending slows the economy. It slows the economy even more than raising taxes slows the economy. So if we cut spending, we cut revenue. If we raise taxes we may raise revenue, but not by the amount we’ve raised taxes because a slow down in the economy will also occur.

So let’s assume we can compromise and agree to cut spending significantly and raise taxes on the wealthy. How do we prevent those steps from leading to a deep recession?

When one person works 50 hours a week, has no vacation, and can barely pay his family’s expenses while another works 40 hours and makes loads of investment income

But you aren’t looking at any of the rest of the picture. For example, has the one sacrificed 6 years of his life in order to go to college, earn a rigorous degree? Is the other, perhaps, 19 years old and just entering the labor market? Perhaps the one is the gifted surgeon and provides life saving skills while the other dropped out of high school.

There isn’t a backstory to your story.

the latter certainly can pay more with less pain than the former.

Yes, but that isn’t the threshold we were founded on. We were kinda founded on the opposite of that; that our property is out own.

I do have a quandry – cutting spending slows the economy. It slows the economy even more than raising taxes slows the economy.

Well….only kinda. It’s because our GDP is made up of corporate, consumer and government spending. So when we cut spending, by definition, we hurt our GDP. But cutting government spending only strengthens the corporate and consumer sides.

So let’s assume we can compromise and agree to cut spending significantly and raise taxes on the wealthy.

I actually favor that compromise. I came out of my chair when those knuckle heads all raised their hands to walk away from a 10-1 cut-tax deal. My favorite way out would be to simply cap spending INCREASES as no more than 2% from last year’s spend. We’d be out in no time.

Remember, revenue grows virtually every single year without touching the rates.

In many cases people have really fun college careers and then get a good high paying job. Sometimes people work hard from 18 on, having to sacrifice college to help the family get buy, and despite hard work are never able to get a high paying job — though someone else may be making a lot of money on their labor. I can make a strong argument that owners make money off the labor of others and just because the market allows it doesn’t mean it is any less theft than if it is taxed. That’s the thing – there are many perspectives to look at this. In my gut I see so many people living with so much more than they need because of how they are privileged in the system. I see many struggling to get buy, harmed by budget cuts and looking not for a hand out but opportunity. So when the wealthiest – who have made out very well in recent years – are asked to pay a bit more and they say “no, just make cuts on those who are really struggling,” well, that is WRONG. I don’t need an abstract logical justification to know that.

I can make one (exploitation of the middle class and workers by the elite), but it’s common sense.

Also, cutting government spending does not strengthen the corporate or consumer sides, it actually harms just as much as tax increases harm it. That’s because government spending adds to demand (to corporations and for consumption). Spending cuts of any sort, whether private sector or government spending, slow the economy. Spending cuts actually do more harm than tax increases.

But despite intense disagreements philosophically, we are closer on pragmatic grounds. Spending has been unsustainable, and there is no will to accept tax rates that could pay for it. Politically, the GOP won’t agree to tax increases for anyone without significant spending cuts. The Democrats won’t agree to cut spending without tax increases. Since we got to this point by cutting taxes while increasing spending, the only way out is to increase taxes while cutting spending. It’s bitter medicine, and may mean we have to deal with an on going recession as the economy gets restructured to a sustainable budget. It also will take decades — if we at least start going the right direction, we can do it.

In many cases people have really fun college careers and then get a good high paying job.

Me, for example. I had a GREAT time in college. But I majored in engineering and mathematics. Additionally, I worked through the entirety of my collegiate career save my freshman year.

Then I spent a good number of years bouncing around earning not good money at all. Then, when my experience and hard degree hit, I got a good job.

But between then and graduation, I often worked 2-3 jobs and never felt abused or left behind.

That’s the thing – there are many perspectives to look at this. In my gut I see so many people living with so much more than they need because of how they are privileged in the system. I see many struggling to get buy, harmed by budget cuts and looking not for a hand out but opportunity.

Those are words without meaning. The Left never quantifies what that means and relishes in the rhetorical power. On one hand you claim that college is a time to explore learning for the sheer wonderment of it. Them, when these youngsters have discovered that their hobby, at 10k a year, provides no meaningful chance at a decent job, they are somehow to be excused for their indiscretion and be provided for by someone who perhaps sacrificed the “fun” majors for the ones that would result in a a career that could support a family.

What, exactly, am I to do for someone who, having the benefits of wealth, decided to major in women’s studies and is shocked that he can’t find a j ob. What “opportunity” would you suggest I give that young man? In what way and manner am I able to offer him a “chance” that he doesn’t already posses?

Also, cutting government spending does not strengthen the corporate or consumer sides, it actually harms just as much as tax increases harm it.

This is nonsense. Government spending on cash for clunkers is a massive waste of money. It’s not even comparable to equate the two.

Politically, the GOP won’t agree to tax increases for anyone without significant spending cuts. The Democrats won’t agree to cut spending without tax increases. Since we got to this point by cutting taxes while increasing spending, the only way out is to increase taxes while cutting spending. It’s bitter medicine, and may mean we have to deal with an on going recession

Agreed. I would agree to do both. Heck, I’d even agree to let taxes sit where they are, no increase or decrease, and raise spending but limit it to 2%.

So we come closer to agreement on pragmatics than on philosophy — I guess that’s the American way. Economists have always said direct spending in the economy does more to stimulate it than tax cuts, since tax cuts might go to invest off shore, buy foreign produced goods, or be used to pay down debt. In terms of stimulation effect, generally direct spending does more than do tax cuts. That’s basic economy theory, though I can imagine some programs do better than others.

Most people who lack opportunity are in the position they are for structural reasons – they were born into poverty, and have limited capacities to move up. Many work long hours for little money. I don’t think it’s quantifiable, since the system is complex and we don’t have access to enough information to quantify it. But I believe it’s real, I know it’s real! I meet so many hard working people who earn so little, and yet are harmed by cuts and this economy, while super wealthy want to protect themselves from any tax increase, even though it won’t harm them. To me that’s just perverse.

But that’s just me – it’s my political perspective and I’ll act on it, you act on ours. Luckily, our pragmatic compromises aren’t as far apart!

The country was founded when a powerful central government took too much in taxes from the people . The Constitution was nothing but a document to protect the people from the ravishes of the next central government . In 2 plus centuries a corrupt Supreme Court has gradually failed to protect the Constitution from being weakened by a power mad Federal Government . Amazing how the English Language can be twisted into a pretzel .

Taxes are the weapon of choice to attack the citizenry . But is must first be divided before it can be conquered . In the Revolutionary War, the British never tried to split Americans along class lines and they lost . Our current rulers have not made that mistake . The people have cheerfully voted to confiscate the wealth of anyone who has more than them while voting themselves free money and free cell phones . They have willingly put the noose around their own necks . All in the name of equality . Though as in Animal Farm the Pigs are more equal because they rule us .

Pino, to argue economic theory with those who blindfold themselves will not succeed . Unfortunately we will have to learn the hard way . We are all Greeks now .

A problem with your argument, Alan, is that tax rates in the 50s were extremely high. They were reduced in the 60s, and again in the 80s. Now they are the lowest in any time since 1914. So we’ve seen tax rates fall consistently over the last half century. Even if the Bush cuts are rescinded, we’re back to rates from the 90s which were well below rates under Ronald Reagan. So taxes have been dropping, not rising over the years. Capital gains taxes have been cut. The taxes on the wealthy have consistently been cut. We’ve been voting for decades to confiscate LESS, especially less from the wealthy! So your claims bear no resemblance to reality. The problem is that while we’ve been cutting, we’ve also been borrowing. Debt is the problem. But taxes are the lowest in nearly a century, and have been declining since the 60s.

A problem with your argument, Alan, is that tax rates in the 50s were extremely high.

And a problem with yours, Scott, is that revenue remains the same; the same amount as a percent of GDP is realized.

Even if the Bush cuts are rescinded, we’re back to rates from the 90s which were well below rates under Ronald Reagan.

I agree, we should go back to 90’s era rates. Taxes AND spending.

Deal?

We’ve been voting for decades to confiscate LESS, especially less from the wealthy!

And transferring it directly to various citizens in the form of entitlements or tax credits.

But Pino, that still undercuts Alan’s argument. 90s spending was low because we were at full employment and the economy was booming. Once we get back to that, by all means, much less spending!

Once we get back to that, by all means, much less spending!

This goes back to your bad thinking that the government has to spend its way out of economic trouble.

I’m just following neo-classical economic theory. After all, the only reason people think the fiscal cliff is a problem is because it takes money out of the system via spending cuts and tax increases. We’ll get a deal, either now or early in 2013. The GOP realizes that Obama gets (and politically needs) to win on the tax rates going up for the top 2%. If Obama caves on this, he does political damage to himself and his party – he can’t. The Republicans can’t win on this, though, since all tax rates go up on January 1 and as soon as they do Obama will offer “Obama tax cuts for the middle class” which the GOP can’t avoid supporting. So they’ll have to bite the bullet and say, “OK, but we need real spending cuts in order to support these revenue increases.”

After all, the only reason people think the fiscal cliff is a problem is because it takes money out of the system via spending cuts and tax increases.

Personally, I’m all for going over the cliff.

Again, for different reasons we come up with the same position!

Scott,

You cannot cherry pick time periods and compare them as if they are identical except for taxes. The 1950s are a unique case that unless you are willing to compensate for the differences in the US economy, should never be used as an example . The economy was good despite the tax rate . Remember even JFK in the early 60s was for tax cuts . http://www.wnd.com/2004/07/25640/

The entire period from 1946 through 1970 is unique in American history . How about you stick to 1970 to the present ? I believe I have stated this before, but I will restate it . Our economic competitors , former foes and Allies were pretty much still not recovered until 1970 from WW2 . After this time we felt the full force of competition in manufacturing from W. Germany and Japan . We also lost the greatest economic advantage we had over those and other competitors, our energy independence . I know you lived through the 1970s energy shortages as I did .

We are arguing taxes and Federal spending as factors for economic prosperity . Now make your argument using the time period I specified and I believe you fail . Particularly if you include the appalling Obama years . The only period within that time where a Democratic Party President had a good economy was Bill Clinton’s rein . Compare his fiscal restraint to the present spending World Record Holder .

” But Pino, that still undercuts Alan’s argument. 90s spending was low because we were at full employment and the economy was booming. Once we get back to that, by all means, much less spending! ”

The chicken or the egg . We will never get there from here , not by Obama’s ideas . So guess what, we will finally cut spending when we go bankrupt . We will finally get entitlement reform when we are bankrupt . Our generation will not pass quickly enough to save SS and medicare . Obama is doing what Democrats do best, kick the can and blame Republicans . The man has just wasted 4 years in dealing with our long term structural faults .

Alan, I’m not cherry picking, I’m using THE ENTIRE HISTORY of the US income tax from 1906 onward. In that entire time we’ve NEVER had rates this low for the wealthy since 1914. NEVER. That ain’t cherry picking, that’s a whole century! Obama is calling for taxes lower than 90% of that time. So to claim we’re increasingly taxing the wealthy is wrong – your claim is clearly contrary to history. Admit you’re wrong. Look, Obama wants a modest increase in taxes on the wealthiest to 1990s levels – and the economy did well then. It’s lower than the rates under Reagan. Obama wants to cut spending too, but the GOP won’t get a deal on that until they agree to the higher rates. The GOP has no choice but to go along with this, and they can claim victory because there will be significant spending cuts. The asinine “pledge” to Norquist and refusal to accept any tax rate increases will demanding cuts (and they will have to accept military cuts as well) is why the GOP looks so bad lately. It looks like they’re being extremists, unwilling to meet halfway. I think Boehner and the pragmatists in the GOP want to, but a few extremists are holding them back — the same extremists that prevented the GOP from winning the elections this year.

In that entire time we’ve NEVER had rates this low for the wealthy since 1914. NEVER.

Are you interested in taxing to generate revenue or are you interested in taxing to correct social injustice?

Look, Obama wants a modest increase in taxes on the wealthiest to 1990s levels – and the economy did well then.

Do you think that the economy did well in the 90’s due to the exact rates? Or perhaps the economy did well due to the fact that Eastern Europe opened up to trade as the Soviet Union dissolved? Or, maybe it was the deregulation of the telco’s that led to the massive innovation of the internet and the dot com boom?

But, if the tax rates of the 90’s are some fantastic target, will you be willing to return to 90’s level spending rates?

Scott ,

If I believed you had proved me wrong, I would admit it as I did on the election . I must have missed where you cited data from 1906 until now showing tax rates on the rich against the economic growth rates and employment rates in each year . That is what you would have to do to make the case that you just made . ,,, And you did not . All you did was cite the 1950s prosperity and tax rates to make your case . If only we could devastate the rest of the World, so that American industry had no competition in it’s home market and regain a large surplus of oil and your 1950s tax heaven would work .

What ever higher taxes the President eventually gets will not close the deficit gap . When, not if that happens please tell me what excuses you will make up to cover these failures to close the deficit ?

Lastly, what makes you think that President Obama has any intention of making spending cuts ? He will force the GOP to give him higher tax rates and then make his usual phony cuts . His left wing base will not allow it . Can you say $ 12 Trillion in new debt over 8 years ? Wanna bet ?

All I said is that tax rates are the lowest now for the wealthy since 1914. Do you deny that? Obama only wants tax rates on the top 2% to rise to levels they were during the Clinton years, below what they were during the Reagan years. Do you deny that? You haven’t denied anything I said, as far as I can tell!

I agree there has to be changes to entitlements and cuts. I think Obama will agree to them, but only in return to new revenue (which he’ll get in any event when the Bush tax cuts expire). I think the Democrats control their left wing base, I don’t think Republicans control theirs.

Scott,

What really is your point of raising taxes on the 2 % ? Is it about revenue or punishment ? I say that when Boehner caves, it will not just be the rich who pay . Once the dam breaks , we will all pay . Your guys have shown they can’t control themselves . Like all gamblers, give them more money and they will spend it . And you will defend that .

Again I dare you to rebut me, your Democrats want no spending cuts . By spending cuts, I mean real ones . By real ones I mean SS and Medicare . That is where the real savings are . Democrats say entitlements are off the table . President Obama has offered nothing in exchange for Speaker Boehner totally caving . As a TV pundit just said, Barak is giving Boehner the Michael Corleone negotiating offer from the GodFather part 2 ” My final offer is this, nothing . ”

What in the universe could make you believe that Democrats can control their left wing base ? They have fed them red meat to win the election . They are throwing more blood in the water now with the fiscal cliff fiasco . You don’t shut it off , you can’t and still keep your head .

It’s part about revenue, it’s part about politics — there is no way we can make cuts that hurt mostly the poor and lower middle class without having those who have made out really well pay some as well. They can afford it without much impact on their lifestyle – a budget cut can mean a child doesn’t get medicine.

Republicans don’t want spending cuts either (that’s why they’re afraid to get specific). But they both want to slow the rate spending increases which, combined with growth and more revenue, will start to pay down the debt. The GOP hasn’t put specific Medicate and SS cuts on the table because they’re scared as hell of what that would mean in 2014. They don’t want to vote on them either.

Me, I think the entire Bush tax cut should be eliminated, not just the top 2%. So I’m fine with going over the fiscal cliff. Raise taxes on everybody and then figure out if cuts are feasible or helpful. I’d go with the entitlement cuts that come with the cliff as well as the military spending cuts. So to me let’s go over the cliff – it may be the best option, especially as monetary policy is going to keep the economy afloat.

We have the lowest taxes in the industrialized world, yet we’re trying to maintain an imperial foreign policy. Something has to give.

there is no way we can make cuts that hurt mostly the poor and lower middle class without having those who have made out really well pay some as well.

The problem is that those programs have grown larger than they ought to have. This is not a case where folks who are on the receiving end are perfectly matched with the benefit; the benefits are too generous. We can’t say, for example, that we need to extend unemployment to 99 weeks from the normal 26 and THEN complain that we’re “cutting” that program when we go back to 26 weeks.

Republicans don’t want spending cuts either (that’s why they’re afraid to get specific).

I agree. They ALL wanna spend.

Me, I think the entire Bush tax cut should be eliminated, not just the top 2%. So I’m fine with going over the fiscal cliff. Raise taxes on everybody and then figure out if cuts are feasible or helpful.

Me two. I wanna see 30 million households react in horror to they AMT that they will be exposed to. You will see the folks scream should that happen.

Scott,

You can’t be that naive. Your guy Obama does nothing but play politics with everything. If Republicans go first and are specific on cuts, you know your guy will bludgeon them with lies about how they are screwing the poor in favor of their rich buddies . You know in your heart I am right .

In case you have forgotten, your guy President Obama has raised spending to an enormous level . And do not even try the false argument about his % of increase is below Bush’s because it is based on 2008 which is an atypical year . A lot of Patronage can be cut . That is really why Democrats will not cut a cent . It is about power .

I do not ever expect to be rich, and I have no rich friends so I should agree with you on your class warfare, yet I do not . It is because I have seen how destructive it is to the poor and middle class. Your ideas are failing in California, failing in Western Europe, and are failing in America. Your guys have rewritten the history of the Reagan years to further justify Obamanomics . They have waged the most brilliant propaganda campaign in American history and convinced most Americans that tax cuts for the rich blew up the economy . The old Soviets could only dream of that .

Why would Republicans commit suicide on SS and Medicare ? Your guy should be leading instead of obstructing this issue . You know what needs to be done, SS and Medicare ARE going broke and your side does nothing but , lie about it . Tell me that raising taxes will save them, I dare you .