Setting the stage.

My argument is that government policies created an environment that encouraged loans to individuals that had an elevated risk of defaulting on those loans. In many cases the government sponsored enterprise directly encouraged the loans and in others, the actions of those GSEs encouraged others in the market to make riskier and riskier loans themselves.

First, how did Fannie and Freddie define loans:

To better understand how this accumulation of weak mortgages came about, a description of the loan classification system used by Fannie and Freddie (the GSEs) and followed by others is in order. Fannie and Freddie did not classify subprime and Alt-A loans based on objective risk characteristics but on the basis of how the lender or securities issuer classified a loan. Thus a loan was only subprime or Alt-A if a lender or issuer denominated it as such.

Fannie and Freddie didn’t perform any due diligence on their own. When did Fannie and Freddie acknowledge this?

What does this mean?

…one of the key triggers of the Financial Crisis was a policy decision to promote the widespread use of high LTV (highly leveraged) lending in the early 1990s. The risk inherent in high LTV lending was well known. When Fannie decided to proceed with a 97% LTV program in 1994, objections were made – pointing out the poor experience on 95% LTV lending just a dozen years before…

And that risk?

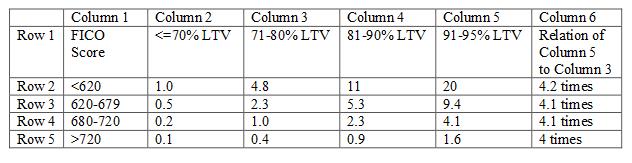

The risk in proceeding with a 95% LTV loan is about 4 times the risk compared to a conventional 20% down loan. The table above demonstrates.

Consider an individual taking out a loan; credit score between 680 and 720. Further, they are putting down between 20 and 30%. Their risk is assigned a value of “1”. The same individual taking out a loan but only putting down between 5 and 9%? The risk moves to a rating of 4.1. Four times the previous rate.

These were the types of loans that Fannie and Freddie, indeed, other government agencies, would be encouraging.

The beginning.

Um, this post has nothing to do with the housing bubble. The housing bubble wasn’t even primarily subprime loans. If it were just too many loans to poor folk who shouldn’t buy a house it would not have caused a crisis. Again, the housing bubble was NOT caused by loans to poor people! It was caused by greedy big banks scheming with derivative trades and demanding mortgages to turn into bonds, without worrying about the risk. Mortgage lenders thus did not diligence, the banks bought them up, and everyone thought they were passing risk along. It was lack of effective government regulation that caused this – in that you can blame the government. In Ireland and Spain, who followed similar deregulatory policies, similar bubbles burst (since the same thing happened in other countries that had similar financial regulations, it can’t be because of Freddie and Fannie). There are ways to criticize the GSEs, but they didn’t cause the bubble!