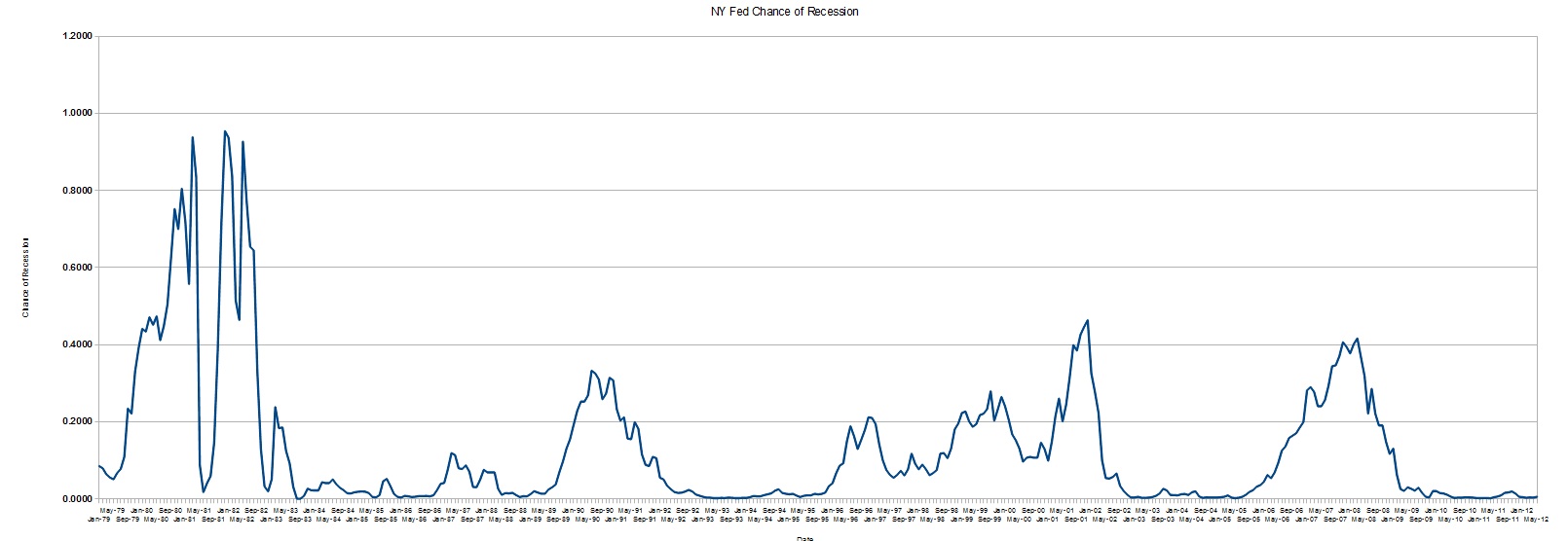

I’ve been a reader of Mark Perry’s for years and years. I love his stuff. One of my favorite installments that he runs is the “Chance of Recession”. Here, he highlights data delivered by the New York Federal Reserve bank.

I’ve been a reader of Mark Perry’s for years and years. I love his stuff. One of my favorite installments that he runs is the “Chance of Recession”. Here, he highlights data delivered by the New York Federal Reserve bank.

The bank does a neat analysis of some different values and comes up with the chance that the economy will be in recession in the next year. The data isn’t perfect, but the rough strokes are enlightening.

Let’s look.

Using the most recent data, the NY Fed is predicting that the chance of recession is…

0.6%

Not even 1% but just over half of one percent. In fact, if you wanna date in which that value was higher than 1% you would have to go all the way back to February of 2009.

Here’s the chart:

Pretty positive.

Now, the problems I have with the data and the “predictive power” of the Fed. They seem to default to local weatherman. They won’t say it’ll rain, but when they say there’s a 25-30% of showerrs, count on it.

The chance of recession is hardly ever even close to 100. In fact, most recessions don’t even have a better than 50% chance.

In the background, I’ve built in some deeper indicators that try to establish trends within the numbers. Then, based on those trends, I’ve set up warning signals. Some of those alarms went off just about a year ago, the potential for recession in the fall of 2011 was beginning to rise. However, by winter last year, the outlook fell and we seem safe.

A neat comparison to this model is what people are willing to “pay” for:

This chart shows the market for the economy going into recession in 2011.

This chart shows the market for the economy going into recession in 2011.

Now for 2012:

20112 doesn’t look as good as 2011. Then again, we’re nearly half done with 2011, so, there’s that.

20112 doesn’t look as good as 2011. Then again, we’re nearly half done with 2011, so, there’s that.

With that said, those who are willing to bet money say that there is twice the chance in 2012 than now in 2011.

Something to think about.