The great debate of the day is The Compromise™. Or rather, what we’re gonna do about taxes on the rich. Obama ran on it for two years beginning in 2006. Liberals believed; believed either that he WOULD let the Bush Tax Cuts expire or that he COULD let the Bush Tax Cuts expire.*

And he didn’t.

He neither could nor would. And the great debate rages.

The Left is furious, FURIOUS I tell you, that the rich are seeing their tax rates extended. The Left wants to see the taxes on the rich go UP. And they’re pissed that those rates will remain unchanged.

But an interesting thing occurs when you query those Leftists. When you ask them calmly, why, exactly, they think the tax rates on the rich “Ought” go up, they stare and just –

Blink.

I have, I HAVE asked them why they think the rates go up. I ask them if they want the rates to go up because they think it’s their moral responsibility to take from those who have and give to those who have less. Or, OR, perhaps they think it’s good economic policy.

See, I argue that when tax rates are lower, the folks with the wealth respond by investing and growing the economy. When presented with this theory, the Left simply repeats the droning of the Statists.

Take The Conservative Lie for example, on a post over on Drudge Retort he argued:

Until reagan, economics were fairly simple. His new “voodoo” economics, which favor the supply, or corporate, side of the equation over the demand, or public, were pretty new. He cut taxes, and then almost immediately had to institue one the largest tax increases in history to make up for the mistake. And it didn’t create jobs. Bush the Lesser tried it again to an even greater degree, and again, it didn’t create jobs.

Normally I respond with words stating the opposite. This results in a shouting match, however, and no one is satisfied. So I ran the numbers. And this is what I got:

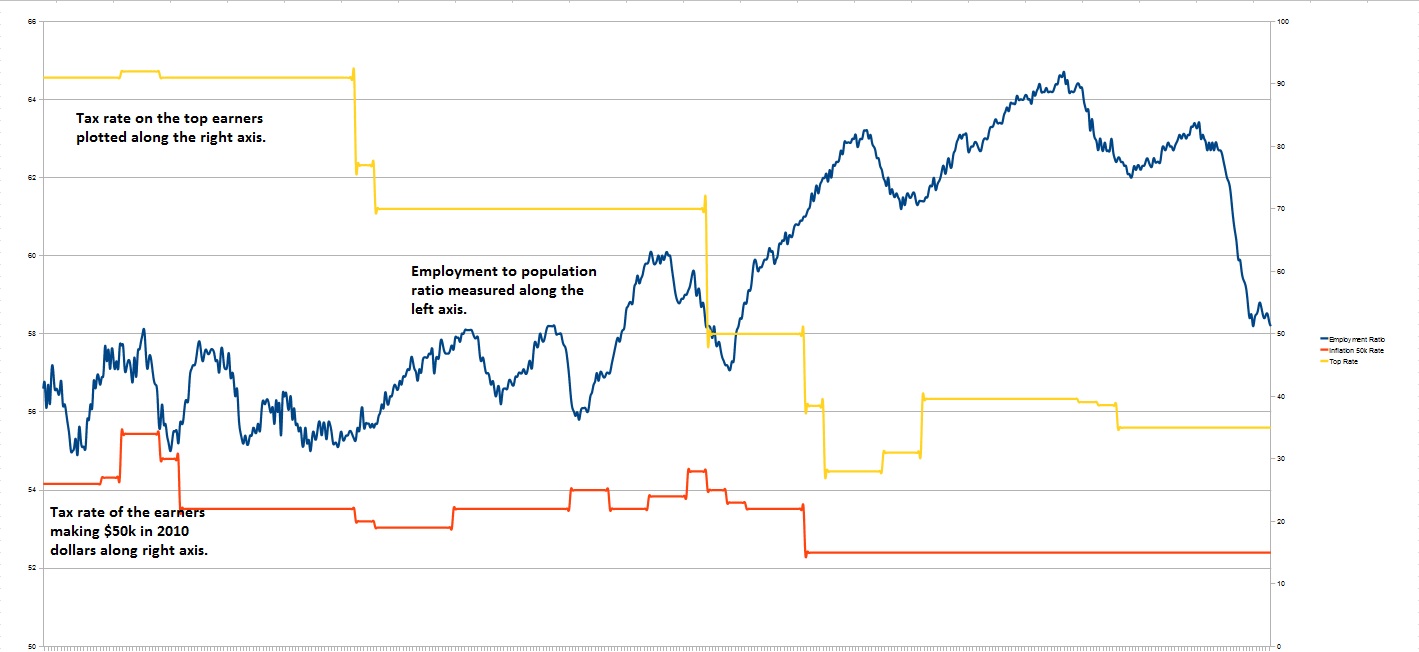

Okay, so as a measure of “creating jobs” I used the measurement called “Employment to Population Ratio”. Basically, this measures how many jobs are created or lost as a measure of the population. I graphed this along side two tax rates:

- The highest marginal rate

- The marginal rate for inflation adjusted salary of $50,000 in 2010 dollars. For example, in 1948, that salary was $5,500. And the tax rate on $5,500 was 26%.

This is what I got:

Pretty, huh? Lot’s of colors.

But take a look. Beginning in 1948, the ratio is pretty flat. Some ups and some downs. And the whole time the tax rate stays the same. But something happens in 1964….the ratio climbs. And it climbs as the tax rates goes from 91% to 77%. And again in 1982. The rates are slashed again. And again the ratio takes off.

In fact, every time the taxes on the wealthiest of America are cut, the ratio goes UP. The only counter evidence to this is the Clinton tax hikes. In 1993 he raised the rates and the ratio still increased. However, this was during the time of the dot-com surge and may represent an anomaly.

Okay, so, what are the trends? We’ve seen the specifics, what are the long-term trends as it pertains to lower taxes and higher job creation? Let’s look:

Wow!

I have been pretty confident in my belief that lower taxes encourages growth, but this is just STUPID! Over the last 60+ years the data shows that as taxes are decreased jobs are created.

But to be sure, I wanted to see, in detail, what occurs when the tax rate is cut. I want to know, exactly, what happens in that very short period of time before and after a tax cut. So I highlighted the cuts:

The evidence is clear. When taxes are cut, job growth is positive.

The lesson from this? Be aware. When talking about tax cuts with a Leftist, understand that they are either:

- Ignorant of the effects of taxes

- Blatant income redistribution proponents

Either is cause enough to run.

Well done, TR. Looks like you really did your homework – I very much appreciate the graphs.

Because it involves complex systems and therefore a not-so-simple cause and effect relationship, I often have difficulty seeing the direct relationship between lower taxes and greater employment. As a business owner, I know lower taxes don’t in themselves make me hire. Your graphs, however, seem to show that ultimately that’s what occurs in the economy as a whole, that the action of lowering taxes may produce a reaction ultimately of job growth. It appears to show that the two are at least related in the immediate sense, even if not in the direct sense.

Nonetheless, I’m curious as to how your post will be received over there on the Drudge Retort. (I thought Ben was shutting it down for good, or did he lie?) My guess is that he’ll completely dodge a direct debate on the data you’ve presented and simply resort to a temper tantrum – calling you a shill, a sheep, or something more childish and vulgar as is his usual stress response when backed into a corner. That is, however, just a guess.

Well done, TR. Looks like you really did your homework – I very much appreciate the graphs.

Thanks Vern.

I often have difficulty seeing the direct relationship between lower taxes and greater employment.

To be sure, there are many impacting variables. However, the trends are powerful.

Nonetheless, I’m curious as to how your post will be received over there on the Drudge Retort.

Me too. Though I hold little hope of a positive breakthrough.

he’ll completely dodge a direct debate on the data you’ve presented and simply resort to a temper tantrum – calling you a shill, a sheep, or something more childish and vulgar as is his usual stress response when backed into a corner.

I agree. Me thinks he fights to fight. And deep down, he knows his position isn’t tenable.

Pingback: Tweets that mention A Quick Study on the Impact of Taxes | Tarheel Red -- Topsy.com

Credit where it’s due – I see he actually got into the data with you. I think there’s too many variables for any conclusions to be 100%, but regardless – great to see the data, and even more great to see a civil discussion. 🙂

Thanks also for the visit to my blog. I’ll be looking for more stories today.

Credit where it’s due – I see he actually got into the data with you.

He did. And THAT’S a good starting point. We are supported by data.

I think there’s too many variables for any conclusions to be 100%

For sure. This is just looking at a trend, nothing more.

Thanks also for the visit to my blog. I’ll be looking for more stories today.

Good stuff; I’ll be checking it out often.

Ya, he’s good to chat with when he’s coming from an informed position, but I lost interest in all his other b.s.. I’ll enjoy the chart debate from afar 🙂

Re: your visit, let me know what you think of my “10 commandments”. They need work, and would welcome any thoughts/criticisms/additions you might have.